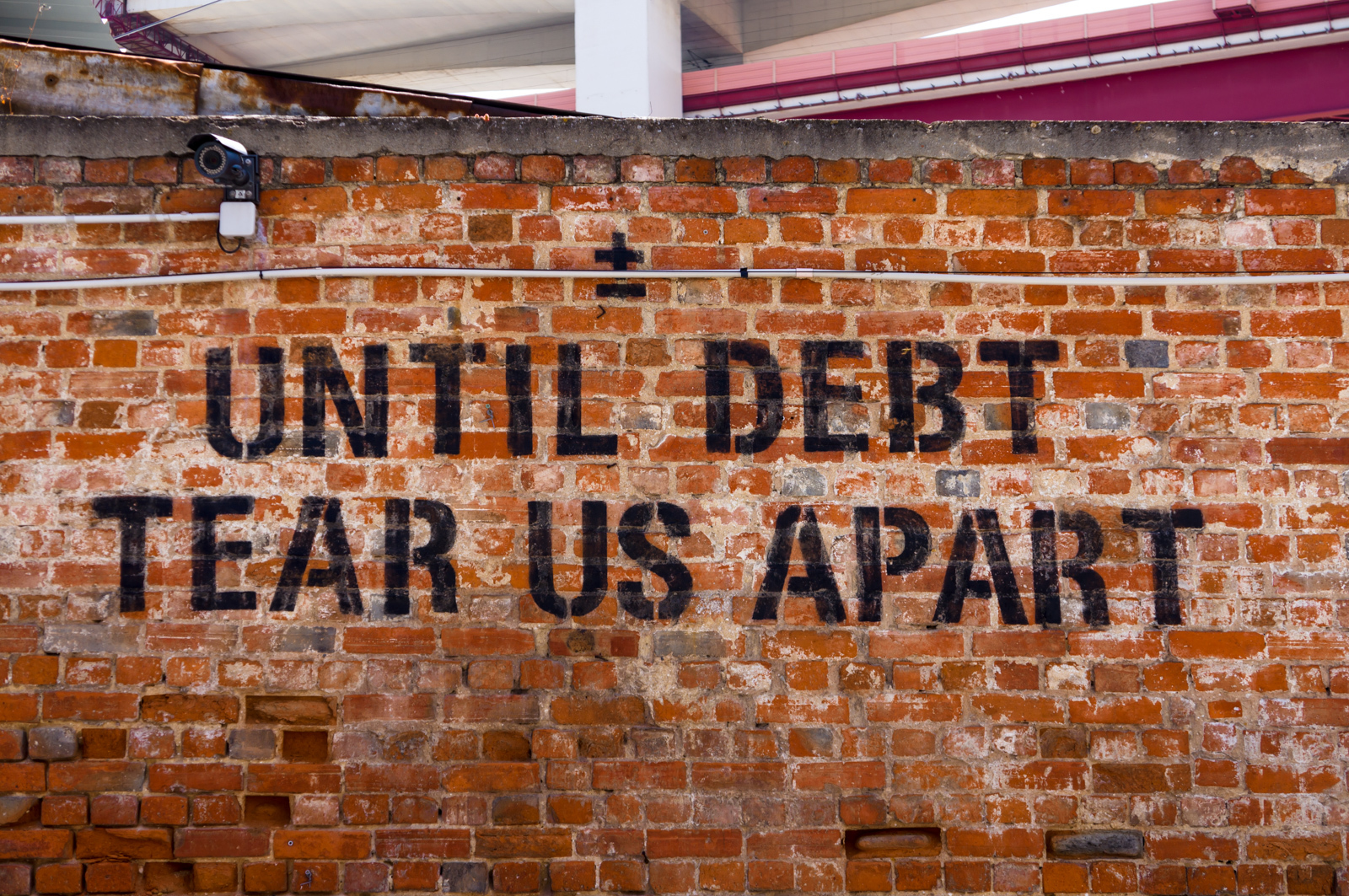

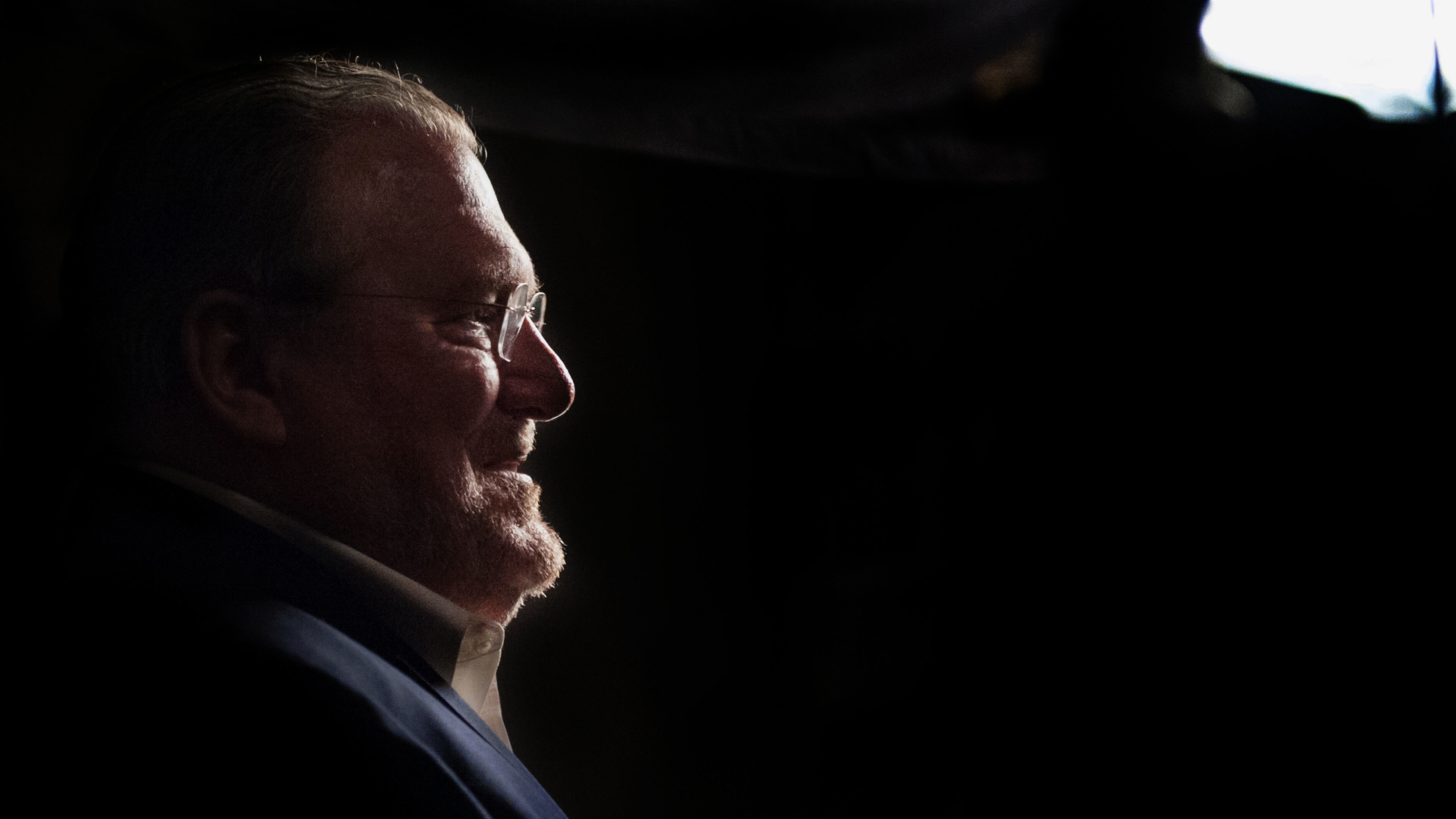

Richard Vague is the author of The Paradox of Debt, which presents a new view of macroeconomics and will be released in July of 2023. He is also author of The Case for a Debt Jubilee, a policy exploration of debt relief, An Illustrated Business History of the United States, the story of our nation’s business progress, A Brief History of Doom, a chronicle of major world financial crises, and The Next Economic Disaster, a book with a new approach for predicting and preventing financial crises.

Richard also serves as managing partner of Gabriel Investments, an early-stage venture capital company.

He previously served Secretary of Banking and Securities for the Commonwealth of Pennsylvania, as Chair of the Pennsylvania Housing Finance Agency, and as board trustee for Pennsylvania’s two largest pension funds, the Public School Employees’ Retirement System and the Pennsylvania State Employees’ Retirement System.

He was also co-founder, Chairman and CEO of Energy Plus, an electricity and natural gas supply company, and co-founder and CEO of two consumer credit card banks, First USA and Juniper Bank.

Richard currently serves on the University of Pennsylvania Board of Trustees and the Penn Medicine Board of Trustees, and on a number of business boards. He is chair of the University of Pennsylvania Press, and chair of the Innovation Advisory Board of the Abramson Cancer Center. He also serves on the Governing Board of the Institute for New Economic Thinking and the board of the Fund for the School District of Philadelphia. He is the founder of the economic data service Tychos (tychosgroup.org), which specializes in analyzing private debt trends, and the email newsletter service Delanceyplace.com, which focuses on non-fiction literature.