What I want to suggest is that the ECB’s Long Term Refinance Operation can help settle the troublesome TARGET balance overhang.

From time immemorial, banks have used correspondent balances as a way of economizing on reserve holding, as well as on the cost of reserve transfers. Suppose that, over the course of a year, the payments between Bank A and Bank B net out. Then there is no need for daily transfer of scarce reserves; daily net flow can simply be added to or subtracted from the outstanding correspondent balance. Fundamentally, that is what TARGET balances between National Central Banks are all about.

Sinn and Wollmershaeuser, in their recent paper glossed by Martin Wolf here, express concern that TARGET balances are not being used as correspondent balances but rather as a political tool, to fund capital transfers within the Eurozone. And they call for Europe to adopt the U.S. rules for running a monetary union (p. 29), most importantly the U.S. practice of periodic settlement of outstanding balances.

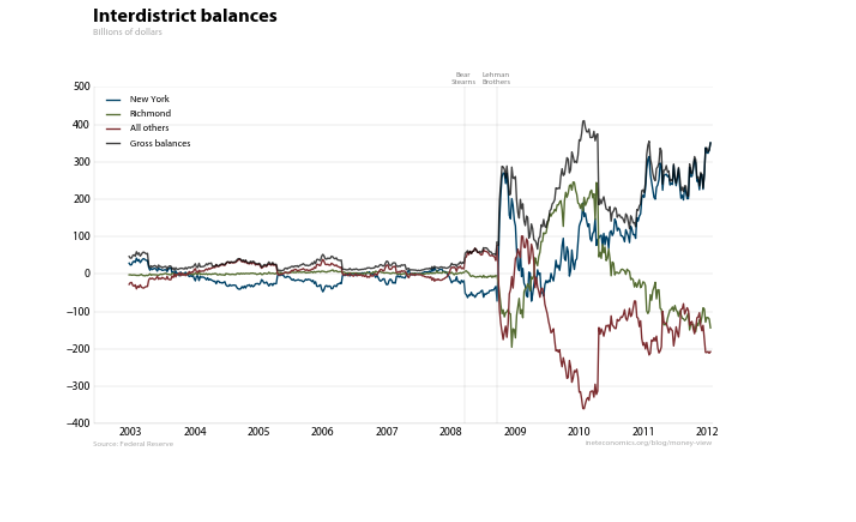

The chart below shows how those rules have played out in the U.S., both in normal times and during crisis

Before the financial crisis of 2007, interdistrict balances were small, and were settled annually in April by transfer of assets from deficit districts to surplus districts. During the crisis, however, interdistrict balances were much larger (almost as large as the TARGET balances), and April settlement did not eliminate the balances. Why not? According to U.S. rules, district banks need only settle the average balance over the last year, not the full amount outstanding at the moment of settlement. (You can see the April 2010 jump clearly.)

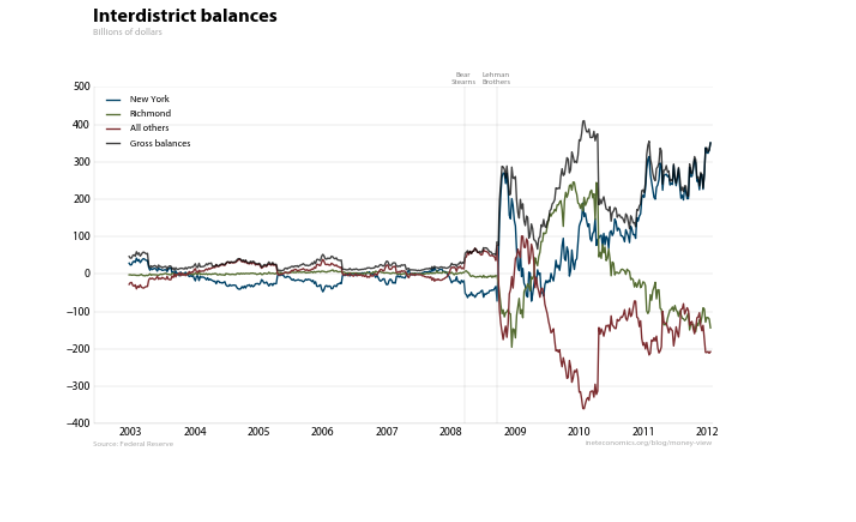

By contrast, here is Sinn and Wollmershaeuser’s chart of the TARGET balances from their paper (Figure 2):

What I want to suggest now is that the ECB Long Term Refinancing Operation has the effect of providing deficit National Central Banks with assets that they can use to settle TARGET balances over time, so that the future TARGET chart for Europe can look more like the current interdistrict chart for the U.S.

To make all this clear, it will help to remind ourselves how correspondent balances work.

For concreteness, suppose that over the first half of the year the flow of net payments is from Bank A to Bank B, eventually totalling 100, while over the second half of the year the flow of net payments is the other way, also eventually totalling 100. That means that Bank A is, on average, borrowing 50 from Bank B. It follows that symmetry in the payments system, and hence minimum total credit exposure, can be achieved by Bank A transferring to Bank B an asset worth 50, accepting as payment a deposit at Bank B. (If Bank A and Bank B were not equally creditworthy, that fact could be reflected by an initial asset transfer of either more or less than 50.) That eliminates the average borrowing, and opens the door for pure correspondent banking.

At the start of the year, A has a deposit at B worth 50. Over the first few months, A settles net payments by drawing down that deposit, hitting zero at 3 months and then going into overdraft. By mid-year, A has a liability to B worth 50. But then the net flow of payments reverses, and by end-year A has a deposit of 50 again. Each Bank spends half the year in debt to the other, with maximal exposure of 50.

That’s the theory but in practice, of course, no one knows in advance what the average over the next year will be. The Fed’s way of handling that uncertainty is to adjust the amount of the asset transfer based on the average borrowing over the last year. Banks that have been in surplus exactly as much as they have been in deficit pay nothing at the settlement, even if they are currently in deficit. But Banks that have been in deficit on average have to settle the average deficit over the last year, which might be more and might be less than current deficit.

When a deficit bank settles, its balance sheet shrinks by the amount of the settlement—both assets and liabilities shrink, as it uses an asset to pay off a liability. When a surplus bank settles, its balance sheet stays the same—it just swaps a settlement account asset for some other acceptable financial asset.

The problem facing the Eurosystem of Central Banks is ultimately a problem of whether the deficit central banks have acceptable assets with which to settle their TARGET liabilities. My point is simply that the LTROs, or at least some of them, can serve such purpose, if not immediately then over time. And there are 489 billion Euro of LTROs, with more to come, a number quite comparable to the 450 billion Euro German balance that worries Sinn and Wollmershaeuser.

The market has responded favorably to the first round LTROs, with most commenters seeing LTRO as a kind of backdoor QE, providing a profitable carry trade for banks which buy sovereign debt with cheap ECB funds. Be that as it may, a money view perspective puts primary emphasis instead on the “survival constraint”, i.e. the requirement to settle net payments at the clearing.

As the crisis unfolded, the buildup of TARGET balances between national central banks was the mechanism that allowed private banks to meet their own survival constraints. But ultimately NCBs are also banks, and as such face their own survival constraints. As the crisis proceeded, balances built up and the NCB survival constraints became more and more binding. What the LTROs do is to provide a way to settle some of those balances, so relaxing the survival constraint for a bit.

We haven’t seen much actual settlement yet, although TARGET balances at the Bundesbank were down by 32 billion Euro in December. But the important thing for financial markets is of course much more the prospect of future settlement than the actual fact of current settlement. And that prospect looks a lot more rosy today than it did a month ago. Maybe the market sees what Money View sees?