The phrase “collateral upgrades” from the former caught my eye: this is the latest of several—quite diverse—variations on a theme that have played out in recent years.

The first variation comes from the global supply of savings. On this topic I think of Martin Wolf’s Fixing Global Finance. For the issue at hand, Anton Brender and Florence Pisani’s Globalised Finance and its Collapse (especially chapter 4) is even more relevant. Both note that the economic policies of developing countries, especially China, led them to generate a large supply of savings. Holders of these savings sought to minimize credit and liquidity risk, and as emphasized by Brender and Pisani, financial innovation allowed them to do so.

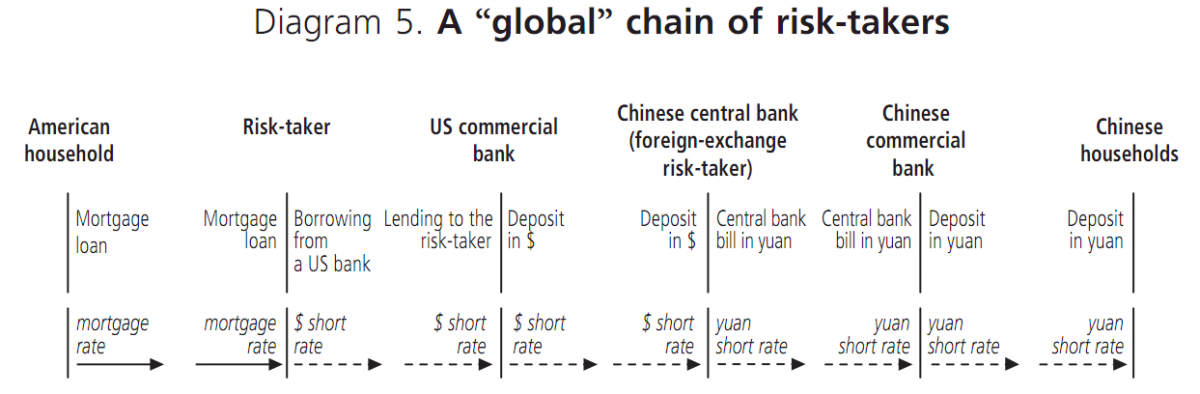

They offer a very stylized example in balance sheets:

The balance sheets labeled “Risk-taker” and “US commercial bank” are really stand-ins for a great many possible chains. The point is that much of the risk inherent in the ultimate use of funds—credit and liquidity risk arising from the mortgage loan—is transferred away before the chain leaves the US; the asset held by the Chinese central bank has neither of those risks, nor do the assets to the right of it in the chain.

Savers wanted safe assets, in other words, and financial innovation created them out of risky assets. The rise of the shadow banking system is, in large part, about meeting the demand for such assets. Developing-country savers were one source of this demand, but there were others too—everyone wanted to eke out some yield while taking as little risk as possible.

This macro situation had its counterpart in the short-term money market: the expansion of collateral eligible for repo borrowing. The short story here is that, especially after 2005, a wide variety of securities, most notably MBS, became much easier to finance. You could use the securities themselves as collateral to borrow in the repo market the money needed to buy them.

In the expansion of repo eligibility, as in the global flow of savings, the transfer of risk was not fully understood, nor was it correctly priced. As the housing market deteriorated, for example, neither securitization nor CDS—two mechanisms for creating safe assets out of risky ones—quite performed as promise. What had seemed to be AAA assets deteriorated rapidly, and the cost of borrowing against them skyrocketed. One policy response was TSLF, by which the Fed sought to meet demand for safe assets in the repo market by lending Treasuries out against lower-quality collateral.

Now Tracy Alloway points us toward new rules for derivatives clearing, which will push up collateral requirements for participants in those markets. Some of those participants do not have ready access to high-quality assets. As Alloway notes, Morgan Stanley and Oliver Wyman estimate $2T of additional collateral may be needed.

This creates a business opportunity, because banks and brokers can provide collateral upgrade as a service to their derivatives clients. But where will the safe assets come from? Not everyone can hold Treasuries. Yet the demand for safe assets is there, and someone will find a new way to meet it.

The ultimate conflict here is simple and universal. Everyone—Chinese savers, repo lenders, derivatives clearing counterparties—wants to hold safe assets. But throughout the economy, much of the credit that is extended is risky. Risk can be redistributed, but not eliminated from the system. Financial stability depends on our understanding where the risk has gone, and how to respond when it manifests.