We have to go back to the 1959 Radcliffe Committee on the Working of the Monetary System in the UK for the controversial view at that time that it was the liquidity of the system that determined spending behavior, rather than the interest rate. The Radcliffe Committee also held the view that the central bank can influence the state of liquidity.

In other words, it is not the quantity of money that determines spending, but the velocity of turnover of money, which the central bank should influence. Since then, the debate has raged between different tools that the central bank can deploy to influence the real economy, through price intervention (interest rate or exchange rate), through quantitative intervention, or intervening in the liquidity of the system as a whole.

One lesson of the recent crisis is better understanding that there is a difference between individual institution liquidity and system liquidity. Individual liquidity does not add up to system liquidity.

There was a puzzle in the run up to the current crisis.

In 2007, despite adequate capital levels, many banks experienced difficulties in obtaining liquidity because according to the Basel Committee on Bank Supervision (BCBS) analysis, “they did not manage their liquidity in a prudent manner.”

In 2008, the BCBS issued guidelines on “Principles for Sound Liquidity Risk Management and Supervision” and issued two minimum standards for measuring liquidity.

The first Liquidity Coverage Ratio (LCR) seeks to promote short-term ability of a bank to have sufficient liquid assets to survive a period of liquidity stress. The LCR measures the value of unencumbered high quality liquid assets against the expected net cash outflows over the next 30 calendar days. The final definition of LCR was agreed in January 2013 with implementation to begin in 2015.

The second standard tries to promote incentives for banks to fund their activities with more stable sources of long-term funds. The Net Stable Funding Ratio (NSFR) is defined as the amount of available stable funding to the amount of required stable funding, which must be greater than 100 per cent. “Stable funding” is defined as the equity and debt financing available over a one-year time horizon under conditions of extended stress.

The definition is quite controversial because different banks want different types of assets to be included as liquid and stable, because what is liquid may not be stable. To date, there is no final definition, and the minimum standard is expected to be implemented only in 2018.

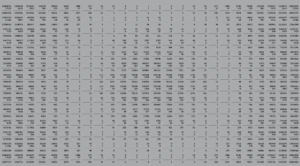

These liquidity requirements only deal with liquidity of individual institutions, not system liquidity. There are two types of system liquidity, real sector liquidity and financial sector liquidity. The former is measured in terms of the velocity concept of money — how much broad money turns over relative to GDP, the proxy for the real sector.

Today, there may be four to eight times the transactions between different financial institutions before there is one trade with a non-financial customer.

For example, a foreign exchange trade with a real sector customer may involve several hedging and funding transactions for that one deal. Add to this proprietary trading and we have huge intra-financial transactions needs.

In other words, in modern, wholesale financial markets, the funding or liquidity needs are huge.

The bulk of turnover of intra-financial institutions can be either through regulated channels, such as clearing and settlement through the official interbank market, or through their own, sometimes unregulated channels — over-the-counter transactions on a bilateral basis, or with shadow banking and offshore institutions as intermediaries.

The interbank market is a regulated official channel. In a market-driven interest rate system, the central bank is the lender of last resort. But in today’s conditions, whereby central banks guide interest rates through their open market operations, the market may not be clear whether the day-to-day interventions suggest that the central bank could be a lender of first resort.

This has a crucial difference for policy and operations. With minimal state intervention, the central bank only need intervene to restore order and stability. So when rates become very tight overnight, the central bank may lend, but that is usually at a penal rate, to ensure that those banks that mismanaged their own funding will learn quickly to get their own liquidity position in order.

In a market where the central bank is often in the market (not just money market, but the bond market or foreign exchange market), and where its action has funding implications, to guide either short-term interest rates or long-term bond rates, then banks may be deluded into thinking that central banks are there to shape the interest rate yield curve and therefore there will be no or little interest rate volatility.

This is a mistaken assumption.

If interest rates are in the long-run determined by the market, volatility in the interbank market is one important indicator of system liquidity. What the recent volatility in the Chinese interbank market is telling us is that there are larger demand and supply conditions in the system that are driving such liquidity or illiquidity.

Hence, the volatility implies that banks and by extension, their borrowers, will have to prepare their liquidity position so as not to be caught by the presence or absence of the central bank in the interbank market.

Market-based interest rates are shaped by supply and demand in the market, of which central bank intervention is only one part, but the most important part will be shaped by the larger credit and liquidity behavior of the banking system and their customers, the real sector borrowers.

Interest rate volatility is the beginning of market-based interest rate reform. It is a good sign and a sign that the Chinese financial system is moving in the right direction.