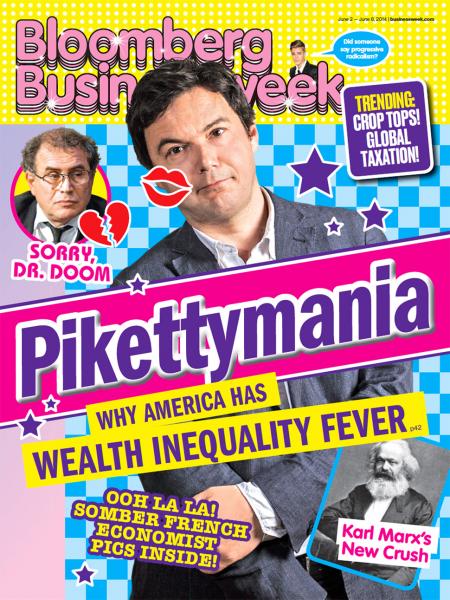

In a review of Capital in the Twenty-first century, Summers praised Piketty’s contributions in data mining and analysis and in a flight of enthusiasm he deemed the contributions deserving of a Nobel.

I am sure - albeit in blissful ignorance of the procedures of the prize -, that Piketty will not get the Bank of Sweden prize. I am reassured that the keepers of our collective intelligence by way of citation metrics, Thomson Reuters, agrees. Although in the past years there have been plenty of betting parlours gaming the Nobels, and with them their cousins, prediction markets, this year the opportunities to cash on my insight are thin (Ladbrokes allowed punting for Literature but no other prize).

The reason Piketty will not win is because the spokespersons of economics have agreed that the phenomenal success of the book and the tome like weight of his contribution has political and cultural interest but no deep significance for economic analysis. Much of the commentary has been on the success of the book deemed “unprecedented” by journalists that rely only on short term memory. (Was Freakonomics not spectacularly ubiquitous in book, magazine, radio, tv, and consultancy company? And a few decades earlier, was not Galbraith selling title after title to the masses? Was not Friedman?) In addition, there is the shy embarrassment of American economist that they didn’t tap the value of inequality in the marketplace of ideas since they were too busy writing about nudging, blinking and sex. Although I should be primed to care about the question: Why have the sales of this book been so spectacular? (My day job (and most nights too) is to study the communication of economics.) The success of the book seems no mystery at all. It is unremarkable that a famous and unique book, a defining cultural event of 2014, sells.

I find myself far more curious about the reception, not by the public, but by the profession. Back to Summers’s review. The Nobel push comes in the first third of the review, for the remainder Summers’ shreds Piketty’s analysis and policy prescriptions. The major sin is the confusion of gross and net (minus depreciation) returns to capital. That point strips Piketty’s book down to a few graphs and some observations about income shares. We learn that Piketty made some sophomoric mistakes. Piketty gives very little allowance to the self-correcting economic forces, to decreasing returns, in sum to the worldview of neoclassical production functions.

Piketty’s Capital is retro cool. It conceives of iron like regularities in the “long duree”. It relates aggregates without microfoundations or statistical theory. It winks not only at Marx but also to the NBER of the 1920s and 1930s. The discussions it has engendered have a 1930s-50s quality. We step into a time machine and come out discussing flow and stock, vintages, gross and net, wealth and capital defined and redefined. We revisit a familiar jiujitsu of definitions with everyone trying to overturn everyone else (aka “capital controversies”). This is certainly not what Piketty wished. His cunning plan was to reorder the discussion by starting with data and eluding the metaeconomics.

Piketty’s flanking move failed because so many economists were glad to award him the ribbon for data but block any further advance by raising a wall of doubt and uncertainty. Summers’s review is illustrative of this. I read him as saying something like, we have the facts of inequality but we don’t know how to explain them. To Piketty’s proposals of financial regulation, Summers responds that “much of the income earned in finance does reflect some form of pay for performance; investment managers are, for example, compensated with a share of the returns they generate”. (They?) Against Piketty’s tax proposal, Summers counters with “the two most important steps that public policy can take with respect to wealth inequality are the strengthening of financial regulation to more fully eliminate implicit and explicit subsidies to financial activity, and an easing of land-use restrictions that cause the real estate of the rich in major metropolitan areas to keep rising in value.” (Is that enough?) Piketty’s expansive vista is narrowed. Piketty’s urgency for action is cautioned as foolish.

Capital, we are told, is too hard to understand and too fragile to play with. Piketty’s book is neither and that is why the public reads it.