A student of microeconomics learns that any competitive equilibrium leads to a Pareto efficient outcome (First Fundamental Theorem of Welfare Economics). What do we mean by the efficiency or inefficiency of markets?

Congressman Henry Waxman: My question is simple. Were you wrong?”

Greenspan: “Partially … I made a mistake in presuming that the self-interest of organizations, specifically banks, is such that they were best capable of protecting shareholders and equity in the firms … I discovered a flaw in the model that I perceived is the critical functioning structure that defines how the world works.

Fama: People who get credit have to get it from somewhere. Does a credit bubble mean that people save too much during that period? I don’t know what a credit bubble means. I don’t even know what a bubble means. These words have become popular. I don’t think they have any meaning. (…)

Cassidy: Are you saying that bubbles can’t exist?

Fama: They have to be predictable phenomena. I don’t think any of this was particularly predictable.

Stock market bubbles don’t grow out of thin air. They have a solid basis in reality, but reality as distorted by a misconception.

Do you agree? Tell us what you think in the comments below.

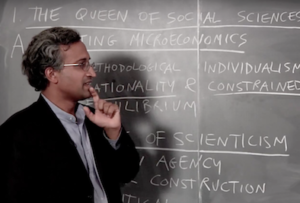

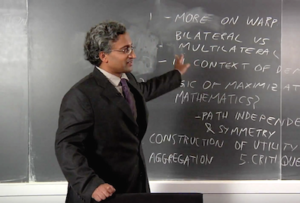

Three years ago, we started working on our blog “Reading Mas-Colell” to present critical commentary on “Microeconomic Theory” by Andreu Mas-Colell, Michael Whinston and Jerry Green, a textbook widely used in Ph.D. programs in economics around the world. We are happy to announce that we are now ready to launch our new course ” Advanced Microeconomics For The Critical Mind”. The course aims to introduce interpretative and contextual content to provide exposure to microeconomics as a domain of unsettled questions and live debates, rather than just a field of applied mathematics.

Please join us in the course for more discussion on the role of mathematics and modeling in microeconomics.