According to many commenters, the controversies that opposed the economists of these institutions (and those that are related to them) are supposed to explain how economic knowledge has been shaped in the postwar period and to this day. Yet, one may wonder what is precisely the nature of these controversies. By “nature” - a term which I have great reluctance to use -, I mean the core of knowledge on which there is a disagreement and also the extent of such disagreement - do they simply disagree on assumptions and/or policy implications, or are we witnessing two different views of the world with absolutely no bridge between them? Most modern economics textbooks seem to want to resolve this issue by employing the quite classical positive vs.normative distinction, arguing that most economists are in agreement about the way economic mechanisms work but differ only in the political implications of these mechanisms. When you add to this bipartite distinction a third dimension, which is what David Colander calls the “art of economics”, this dialectics does not seem to be more difficult to articulate: economists agree on the way economic mechanisms work (positive economics) yet they have different views on the goals we should want to attain (normative economics) and from this they derive different political implications (the art of economics).

These distinctions, however, are quite theoretical. In real life, boundaries are much more difficult to trace. We all see that Chicago economists seem to believe that the markets work quite perfecly or at least that if they do not work that way, no public intervention will deliver more good without creating more bad. For MIT economists, on the other hand, markets failures dominate and public intervention may help solve these problems when the market is unable to self-regulate. Who can say in these streams of arguments where positive economics ends and where normative (or the art of) economics starts? What is the core of knowledge that economists agree upon? Are these views reconciliable in any way? I had all these questions in mind when reading (once again) the Samuelson papers at Duke University. Here are a few instances of what I am talking about.

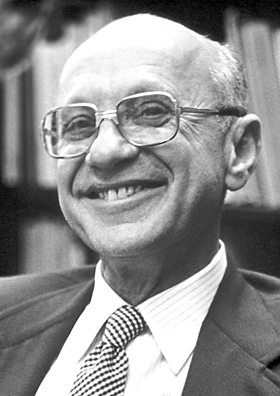

In 1968, Samuelson was consulted by the Nobel committee on who would be worth receiving the first “Prize in Economic Science dedicated to the memory of Alfred Nobel”. Samuelson, who would himself become the first American recipient of the Prize two years later, wrote in response a long letter in which he cited many of his colleagues, including a whole lot who would later receive this Prize. I will not mention all of them, because you have to see the archives by yourself if you want this piece of information but I can say that Tinbergen and Frisch were there, along with some others who were among those we may loosely call the Keynesians and who did not win the Nobel (for instance, Alvin Hansen or Abba Lerner). More surprisingly, though, Samuelson cited Milton Friedman and as a justification for the Prize he mentioned Friedman’s “philosophical adherence to laissez-faire, work on permanent income and on money.” Ok, so here we can see that there is at least a core of agreement, at least on Samuelson’s side. He believes that Friedman’s work on money and consumption is good, good enough for a Nobel Prize, and that even his “philosophical convictions” are not obstacles on the way of scientific integrity. In fact, they are obviously worth praises. This is all good.

Yet, the same Paul Samuelson had written to his friend Alvin Hansen a couple of years before, in the midst of the Phillips curve controversy, the following sentence: “Milton F. is a bloody nuisance. In the end he is not right in his provocative stands, but it takes valuable time rebutting his arguments.” He even added: “Having just returned from UCLA where (as in Virginia and Washington) the place is jumping with energetic libertarian nuts, I realize that so much of one’s scientific life has to be occupied in sterile debate.” * Ok. Well. I always like to argue that logical consistency is for dummies (or for analytical philosophers, if you wish). But even I have to admit this is quite puzzling. How can you say, on one hand, that Friedman’s work is so detrimental that it is not even worth arguing against it and, on the other hand, that even its more ideological side is worth a Nobel Prize? It is arguable that there is a question of audience, here. There is a partisan Paul Samuelson writing to one of his Keynesian friends, especially if we think that Hansen was much involved in politics, and there is a more oecumenical Paul Samuelson who wants to show to the Nobel Committee he can go beyond controversies and recognize “real” scientific achievement. But even if we put it this way, we are left with a few questions. No one jumped at Samuelson with a knife under his throat and forced him to mention Friedman in his Nobel letter. There is at least something that makes Friedman a valuable if definitely annoying fellow. And if we cannot explain the dynamics of this dispute, then, how can we appraise what economics is really about? More precisely, there seems to be here a nice instance of Samuelson’s (and I believe MIT’s) “in-between-ness”, the fact that his views are not easily indentifiable, that they stand somewhere middle between Chicago pro-market ideological stands and Cowles-Rand-Princeton - by way of mathematization - scientism. We really have to characterize this position in a more subtle way if we want to understand modern economics and its larger societal/political significance.

* Paul Samuelson Papers, Rubinstein Rare Book and Manuscript Library, Duke University, Box 36, Folder “Hansen, Alvin H.”