Like every such agreement, it was hailed as another step towards the renminbi’s displacement of the dollar as the world’s reserve currency. Are the renminbi swap lines in fact a genuine step forward for the internationalization of the RMB?

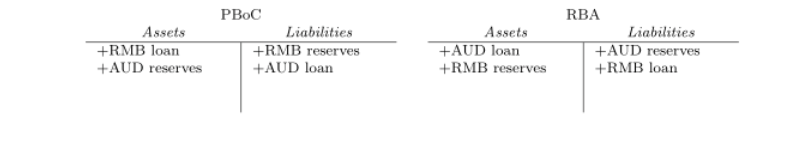

How do these swap lines work? When activated, they become, economically speaking, a swap of IOUs: the PBoC lends renminbi to the RBA, which lends back Australian dollars. The pair of transactions lasts for a fixed term, and at maturity both loans are reversed. Typically the loans would be made and unwound at the same exchange rate, and the compensation to the lender would be in the form of an interest rate fixed for the term.

The transaction appears on the central banks’ balance sheets like this:

(In practice, the central banks may account for the transactions differently. The Fed, for example, thinks of its dollar swap lines as assets, loans collateralized by foreign exchange.)

First, a swap line such as this one is at its heart a liquidity arrangement. It is similar to the other swap lines that have been in focus of late, namely the dollar swap lines between the Fed and the ECB (among other C-5 central banks). As the eurozone crisis peaked, funding for European banks grew extremely tight, and the pinch was felt most in dollar funding markets. The ECB drew on its swap line to the tune of about $100bn, enabling it to lend dollars to its clients, the European banks. The Fed was the ultimate source of those dollars, as it must be, and the swap line provided the channel to get them to Europe.

With a renminbi swap line in place, the RBA can obtain the Chinese currency, in size, and lend it on to Australian banks short of liquid renminbi funds. In this sense, the deal is opening a channel by which the PBoC may one day be able to act as lender of last resort to Australian banks’ renminbi-denominated operations.

In a future with large amounts of cross-border RMB financial activity, this channel could be an important source of stability, and thus its establishment could be understood as building the infrastructure of a comprehensive RMB system.

But such a system does not yet exist, and the establishment of swap lines is not the major obstacle to the emergence of one. A reserve asset, is something demanded for its liquidity, that is the ease of entering and exiting a position. Because of China’s tight capital account, foreigners can obtain and dispose of renminbi in only a limited number of ways. One way is via the trade account, and the swap lines are advertized as being in support of trade.

Another way to get RMB is via the dim sum market for renminbi-denominated bonds in Hong Kong. Dim sum bonds can be used to raise funds for investment on the mainland, subject to fairly heavy regulatory control. They have been also used to raise funds that can be swapped into dollars or euros in the private currency swap market. But what liquidity there is in the dim sum market seems to come at least in large part from the pool of speculative RMB deposits in Hong Kong, looking for a parking spot while waiting for RMB appreciation.

China’s capital account remains closed, meaning it is difficult for funds to move in and out of the country except as payment for trade. It is difficult to imagine the RMB serving as international money until it is backed by a fully functional offshore banking system, meaning high liquidity in capital-account transactions. This does not necessarily mean that the mainland’s capital account must be open, as Hong Kong and London could serve as financial centers for renminbi.

But for there to be sufficient liquidity, there must be a reliable way to get and get rid of RMB. For the dollar, the size and openness of the US economy, with the Fed’s guarantee of liquidity in government debt, ensure this. For China to provide such a guarantee, it will have to loosen its grasp on its capital account, or its exchange-rate policy, and—either way—on its growth model. Swap lines might point the way, but big steps toward internationalization they are not.