Last week Goldman Sachs published a note in favor of the Fed’s adopting a formal nominal GDP target, while Fed-watchers caught a whiff of a possible change in policy in the works. The proposal, specifically, is for the Fed to announce a target level for nominal GDP over the next 12 months, and to commit to undertaking asset purchases if it seemed that NGDP would come in too low. Scott Sumner, who has long advocated such a policy, felt vindicated, and other market monetarists also voiced their support. Even Paul Krugman seemed to think it might do some good.

Nominal GDP targeting is unlikely to work. I am sympathetic to the arguments given by Duncan Black, Robert Waldmann, and Brad DeLong, but to add something to the debate, my emphasis here will be different.

How do proponents defend the idea? First, asset purchases will raise nominal income. Spending on newly produced goods and services is currently too low because people prefer to hoard money rather than to spend it. The Fed’s buying up assets with a sufficient amount of new money, they argue, will eventually satisfy this desire to hoard, after which any new money will be spent instead. Second, setting an explicit nominal target will amplify the effect of the asset purchases. Knowing that the Fed will be pulling out all the stops to reach the target level of NGDP, businesses will invest or raise prices today in anticipation of higher demand over the next 12 months, which will itself increase nominal spending toward the target.

It would work, that is, because the Fed could reach the target with sufficient asset purchases, and if the target is credible, those purchases will not have to be too large.

I disagree, in the first instance because the proposal ignores the context in which the Fed operates. The Fed is a banker’s bank. When the Fed buys assets from “the public”, only a very specific part of the public is meant—commercial banks and securities dealers. These may be able to find lots of things to do with the money thus obtained other than spending it on newly produced goods and services. If more asset purchases are coming, then the smart and easy thing to do is to obtain assets that the Fed is soon going to have to buy.

Just keep buying assets, say the defenders. Seriously massive amounts of quantitative easing may be necessary. Eventually the desire to hoard will be sated and spending will begin. But the banks are already holding a record $1.6T in reserves; why not another trillion? And they have on hand plenty of other assets to sell to the Fed before having to go looking for new ones. How large could the Fed actually get, before political constraints start to bind? At over $2T expansion since the beginning of the financial crisis, real threats to the Fed’s independence have surfaced. What if another $2T, or $10T, proved necessary? Would the Fed’s independence remain secure? I do not think it would.

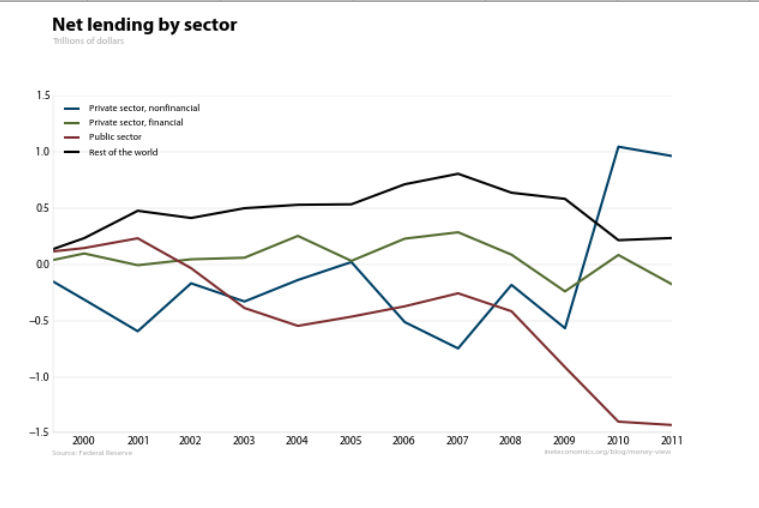

My third objection is perhaps the most fundamental. Deleveraging by households and businesses continues:

That makes this a balance-sheet recession, to Richard Koo and many others, and it seems to me to be a good description of what’s going on. Demand will remain depressed until debt is paid down or written off. But households have nothing that can be sold to the Fed, so asset purchases help them at best indirectly.

It is quite right to have this debate; our situation is dire enough that nothing should be off the table. But NGDP targeting is not a panacea; to think otherwise is to ignore the environment in which the Fed must operate.