Answers to this question usually make reference to the amount of overnight deposits held by eurozone banks at the ECB.

This is the wrong place to look—the amount of overnight deposits doesn’t tell you what banks are doing with the borrowed funds. The error, it seems to me, comes from thinking of the liquidity provided by the ECB as being like water, something that can fill up the banks’ liquidity-holding vessels and spill over via lending into those of non-financial corporations. The metaphor provides a nice turn of phrase (” drinking water from a fire hydrant”), but does not enlighten.

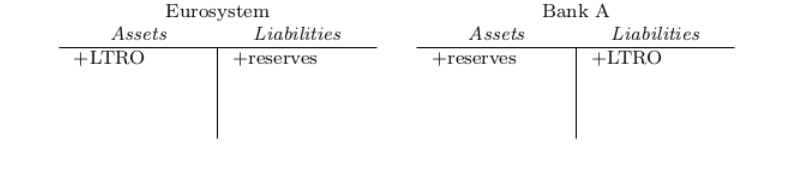

LTROs, like any liquidity-providing open-market operation, expand on both sides the balance sheets both of the Eurosystem (the consolidation of the euro area national central banks) and of the borrowing bank:

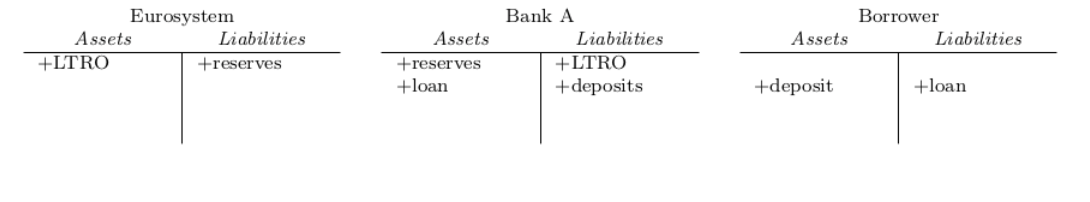

So far so good. What about the liability side? Those who point to the high use of the ECB’s deposit facility seem to think that banks should draw down these reserves and lend them out to businesses. But what actually happens when banks lend? Just as the Eurosystem expanded its balance sheet on both sides in lending to the banks, the banks expand theirs when lending to their clients:

What if the borrower then goes on to draw down that deposit, for example to pay for new investment spending? The borrower’s banks clears the payment by transfering reserves to the recipient’s bank. Reserves change hands, but the total amount of reserves remains the same.

In fact the only way to destroy reserves is to purchase an asset from the ECB itself, which happens at the central bank’s discretion, when it decides to contract its balance sheet.

There is, it should be said, a grain of truth in the hoarding story. If banks were to make loans that increased their deposit liabilities, their required reserves would rise. (Required reserves and excess reserves can be distinguished on the Eurosystem balance sheet.) The marginal reserve ratio is 1%, so EUR 777bn in new reserves could fund EUR 77.7 trillion in new lending.

Even the most diligent of bankers would find it hard to shovel money out the door that quickly, and it does not seem that this should be the standard by which to judge the success of LTRO. The ECB is rightly worried about avoiding a bank credit crisis, and by this measure is having some success.