At times it has seemed the arch-villain, coldly standing on principle even as the financial system crumbles around it. At other times it has seemed the hero in waiting, ready to step in at the eleventh hour to bring a moral-hazard-free end to the turmoil with its unlimited balance sheet.

What is becoming increasingly clear, however, is that the plot is taking a twist. The question is no longer whether the ECB is villain or hero, but whether it exists at all. (And today’s collateral eligibility expansion doesn’t resolve the question.) Let me explain.

The meaning of European monetary union is that a euro is a euro, whether you are in Greece or in Germany. If you have a euro on deposit in a Greek bank, you can use it to make payment in Germany, or anywhere in the eurozone. What’s essential is the payment system, which guarantees this, and it is the normal operation of the payment system that the guarantor of monetary union must ensure.

All payment systems are based on credit. As a first resort, banks can extend credit to one another to clear payments between their customers, credit which will net out as payments flow the other way in the near future. If two banks do not wish to extend credit to each other, a third party can stand between them, extending credit to both parties. The central bank commits to doing just this to uphold monetary union: if a balance sheet must expand to complete a payment, and no one else will do it, then the central bank must. If it does not, then a euro in Greece is not a euro in Germany, and monetary union will have come to an end.

The Eurosystem, the eurozone’s central banks taken as a group, sit at the center of the eurozone payment system, TARGET2. As European banks have become unwilling to extend credit to one another privately, persistent payment imbalances have accumulated as TARGET2 liabilities.

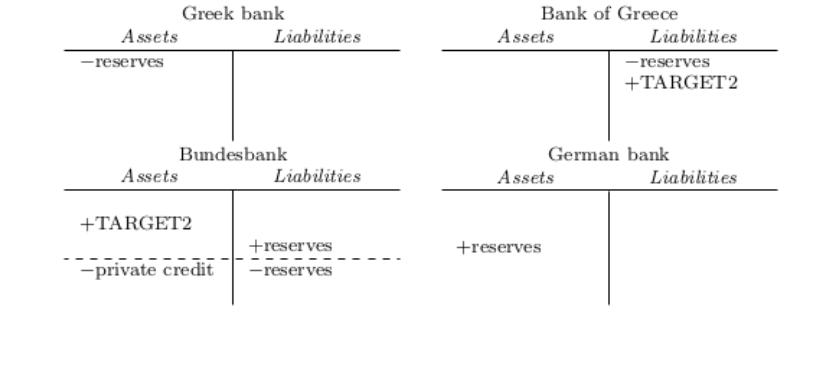

Specifically, Germany’s Bundesbank has accumulated a nearly €500B TARGET2 asset on its balance sheet, and to sterilize this impact, it has sold nearly its entire stock of private-sector debt. This is shown in balance sheets here: a Greek bank pays a German bank through TARGET2, and the Bundesbank then sterilizes.

Payment from a Greek bank to a German bank results in a TARGET2 liability. Below the dotted line, the Bundesbank sterilizes this transaction.

Yet the payment imbalances continue, and for payments to continue to clear, the Bundesbank will have to continue to extend credit to TARGET2. It can no longer do so without expanding its balance sheet, which in practice means accepting deposits from the private sector to fund expanded TARGET2 lending. Yet such an expansion may prove politically difficult for the Bundesbank, so it may wish to avoid it.

So now the question: is there an ECB? If the eurozone is a functioning monetary union, then its payment system will be upheld. Someone’s balance sheet must expand, almost certainly the Bundesbank’s. If it does not, then one of two things must follow.

If the Eurosystem national central banks are prepared to accept unlimited imbalances among themselves, then there is an ECB. If not, then there are a bunch of national central banks facing a classic balance-of-payments crisis, and they will need a supply of international money to resolve it. More to come.