Does general equilibrium theory sufficiently enhance our understanding of the economic process to make the entire exercise worthwhile, if we consider that other forms of thinking may have been ‘crowded out’ as a result of its being the ‘dominant discourse’? What, in the end, have we really learned from it?

General equilibrium theory is presented by Mas-Colell, Whinston and Green in two rather different ways. One is entirely abstractly, as relating to the idea that “we must simultaneously determine the equilibrium values of all variables of interest” (MWG, p.511). One can hardly quarrel with this ambition, if one is adopting an equilibrium approach at all. The other, rather more specific, involves the idea that “it aims at reducing the set of variables taken as exogenous to a small number of physical realities (e.g. the set of economic agents, the available technologies, the preferences and physical endowments of goods of various agents)” (MWG, p.511). Leave aside the point that “preferences” are hardly “physical”. This particular attempt at parsimony will have to justify itself through its successes.

One of the arguments as to why it has been successful is that it helps, we are told, to establish the conditions under which “market economies” have certain desirable properties. Mas-Colell, Whinston, and Green, for instance, claim that the so-called First Fundamental Theorem of Welfare Economics presents a ‘formal expression for competitive market economies of Adam Smith’s claimed” invisible hand” property of markets’ (p.545).[1] There is, however, a critical ambiguity here: do we mean by “market economies” the theoretical objects within the universe of general equilibrium theory or the real fields of activity they claim to model? If there were no relation then presumably the former would lose some of their interest.

As is well known, Cournot, Marshall and others began to establish a mathematical framework for partial equilibrium analysis, and Edgeworth and Walras posed and to a degree addressed the problem of identifying the conditions under which a price system might enable supply to be equated to demand simultaneously in all markets for traded commodities. However, it was only in the early 1950s, with the work of Arrow and Debreu, that research in the area of study that came to be called general equilibrium theory led to a formal demonstration of conditions for such an equilibrium to exist and to have specific desirable properties.

Arguably, the importance attached to research in general equilibrium came in part from the need to address a contrary idea, which had been prominent in the late nineteenth century and the first half of the twentieth: that of the anarchy of the market — the idea that the market is not harmonious and self-adjusting, automatically making its way to equilibrium, but rather unstable and even wasteful and chaotic. General equilibrium has played a reassuring or even quietistic role in countering this view, as evinced from the fact that financial instability and business cycles appear in the theory only through suitable extensions (e.g. unanticipated technological shocks, or shifts from one equilibrium to another through belief coordinating ‘sunspots’). The theory has also found other uses, from establishing the conditions under which there could be so-called micro-foundations for macroeconomic models to providing tools for policy analyses, such as computable general equilibrium models used in domains such as international trade and public finance.[2]

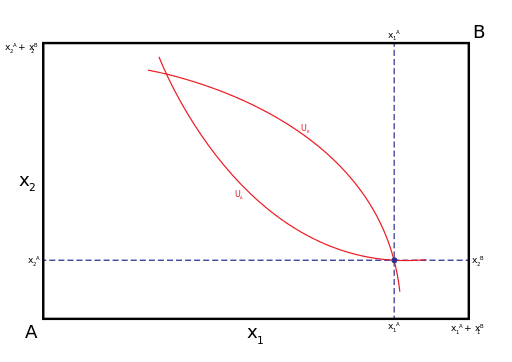

As already noted, a major result is Pareto optimality of the competitive outcome, which guarantees that the allocation generated by maximizing behavior in response to market-clearing prices is such that no subsequent reallocation could improve on outcomes for all of the affected parties. This result may not appear so impressive when considering only two agents, but with hundreds of individuals buying and selling multiple commodities, and firms producing them, it might be thought more surprising. Pareto efficiency is achieved seemingly effortlessly in a decentralized process, doing away with the need for a central planner to know preferences of concerned individuals or the technology of firms. Of course, such an outcome may not be desirable in other respects, as even from a narrowly consequentialist point of view, the outcomes generated may be severely unequal or indeed otherwise undesirable.

A student of graduate level microeconomics encounters early on the grandiosely titled first and second fundamental theorems of welfare economics (henceforth “First and Second Welfare Theorems”). They are often interpreted as separating the question of how to achieve efficiency (the idea that decentralized competitive markets lead to Pareto efficient outcomes) from that of how to achieve equitable outcomes (since outcomes varying widely in terms of distributional characteristics can all be Pareto efficient [3]). The idea that such a separation is implied, however, presupposes both that government has sufficient information as well as capabilities (for instance in the form of efficient ex-post tax and transfer instruments) and that it can be relied upon to implement the desired distribution. Each of these suppositions is far from trivial.[4] The results together might in fact be read as reflecting the stringency of the conditions for markets to be used to achieve desired results rather than their reliability in doing so (for an example of this interpretation, see Hahn, 1988).

The proposition that unregulated markets provide a decentralized allocation mechanism leading to Pareto efficient outcomes (the first theorem), and that any desired outcome among these can moreover be either achieved through suitable pre-market redistributive efforts (the second theorem) has provided a useful justificatory apparatus for existing capitalism. However, the resulting picture does not still put to rest all qualms. Although the existence of at least one Pareto efficient equilibrium can be guaranteed under certain theoretical conditions, stringent conditions are required to rule out the possibility of multiple or indeed an infinite number of equilibria, and only some of these will be stable. Which of the (possibly very distributionally different) equilibria is likely to emerge and the ‘comparative statics’ of what would take place if a given equilibrium is displaced may be impossible to describe; worse, there may not be sufficient reason to expect that economies would converge to any equilibrium at all!

This calls for a cost-benefit assessment. Does general equilibrium theory sufficiently enhance our understanding of the economic process to make the entire exercise worthwhile, if we consider that other forms of thinking may have been ‘crowded out’ as a result of its being the ‘dominant discourse’? What, in the end, have we really learned from it? Despite its very impressive intellectual armamentarium, the role of general equilibrium theory may have been more to provide clarification of the limits of certain ways of thinking than to provide answers to substantive questions. Has the activity of general equilibrium theorists amounted to a lot of ” sound and fury” signifying, if not nothing, then rather little?

Paradoxically, one of the most reasons for worry is the “abundance of riches” in general equilibrium theory. The rich multiplicity and variety of equilibria that are possible and the lack of specification of out-of-equilibrium dynamics leads to a range of possibilities in regard to whether equilibrium is approached at all, which one, and how quickly.

An Embarrassment of Riches

A major intellectual achievement of Arrow and Debreu in the 1950s, extended and generalized subsequently, was the proof of the existence of general equilibrium using fixed point theorems under convexity assumptions for preferences and production sets, i.e. non-increasing marginal utility of the consumption of individual goods, and non-increasing returns to scale in production. In non-convex economies, this is a less straightforward proposition, with some additional mathematical “machinery” (such as Minkowski additions of sets and their convex hulls) deployed to arrive at results. It can be shown that there still exists an “approximate” equilibrium (the Shapley-Folkman-Starr results), but only when the number of agents exceeds the number of commodities (i.e. in sufficiently “large” economies). [5]

Multiple equilibria and instability cannot in general be ruled out. The Sonnenschein–Mantel–Debreu theorem establishes that there are no restrictions on the shape of excess demand functions, meaning that under usual assumptions about consumer preferences, there are no meaningful restrictions on equilibria (including on their stability and number) that can be placed (Sonnenschein, 1973). This result (also known as “anything goes”) is linked to the problem of demand aggregation in the presence of wealth effects and among other things implies that any observed price vector can be justified as the equilibrium vector for some economy (with given initial endowments and preferences). [6] With any specific economy being somewhere in the ‘multiverse’ of possible economies, the explanatory value of the theory and its ability to generate empirically falsifiable predictions can be judged to be weak[7]. Both the number of equilibria and the behavior of an economy outside equilibrium (i.e. whether its ‘dynamics’ will lead to an equilibrium and if so a particular one) are hard to characterize:

- At most what can be said of almost any economy is that it is regular[8] (Debreu, 1970), thereby ensuring local uniqueness. Combined with the index theorem[9], this only establishes that the number of equilibria is odd and finite.

- Aside from very special cases[10], the only readily economically interpretable conditions that imply uniqueness are that (i) the excess demand function satisfies the weak axiom of revealed preference[11] (i.e. the demand side of the economy can be interpreted as reflecting ‘consistency’ properties that would emerge if there were a single representative consumer), a property not generally expected to hold under aggregation of the demand of distinct agents, or (ii) that it satisfies gross substitutability (a very restrictive property that one would not expect to hold in realistic demand systems — namely that increases in the price of a good lead to increases in demand for every other good).[12]

- Only in very special cases (e.g. if there is a single consumer or a representative agent or if there are only two goods) can global stability be established (Scarf, 1960). More generally, global stability is present in the limited cases where there is a unique Walrasian equilibrium.[13] In all other cases, there is no reason to assume that an adjustment process beginning at an arbitrary price vector will lead to an equilibrium at all, let alone ‘quickly’.

To quote MWG (p.620), “economists are good (or so we hope) at recognizing a state of equilibrium but are poor at predicting precisely how an economy in disequilibrium will evolve.” Supplementary assumptions are needed to describe the motion of prices and excess aggregate demand if the system is not in equilibrium already. Fixed-point theorems (Brouwer, Kakutani) used to prove the existence of equilibrium do not provide for an algorithmic procedure that would result in choosing price sequences that may converge towards an equilibrium price vector and stop when such vector has been found. [14]

Where does this leave us? There are no forces that automatically lead economies to equilibria, and situations of multiple (or indeed potentially infinite) equilibria are less pathological than might originally have been imagined. Worse, it may not even be possible to identify all equilibria. Algorithms for isolating fixed points, for instance that developed by Scarf (1973), can at best point to some of the possible locations of equilibria.[15] From a policy standpoint, this would seem to imply significant limitations on a social planner’s ability to implement a desired result. If the equilibrium is not unique, it is unclear to which possible equilibrium the market might converge, and critically whether the “right” intended equilibrium will be approached, if approached at all (Ackerman, 1999). Appropriate policies may be needed to ensure that the economy ends up ‘in the right place’ (Greenwald and Stiglitz, 1984) and the economic insight necessary to provide the required supports will have to come from additional sources.

By being compatible with so many possibilities, the theory lacks explanatory relevance, providing instead a language through which one can say both too much and too little. The theory’s abundance of riches within its own multiverse is to be contrasted with its complete neglect of some important aspects of real-world markets, such as for example the presence of increasing returns to scale, the role of institutions and their effects (including money), and the place of innovation, all of which are difficult to model within the theory.

Does General Equilibrium Really Describe Modern Markets?

The hypothetical Walrasian auctioneer (who announces prices in an attempt to match supply and demand, and attempts to find an equilibrium price vector through a tâtonnement process[16]), is a fiction that can anchor the otherwise free floating metaphor of economic equilibrium, but is one that has consequences, and not simply an “innocuous shorthand way” of expressing how prices might converge to equilibrium values (Bowles, 2004: 216). Economics textbooks do not typically suggest that this simplified account of price adjustment has much empirical validity as a description of the actual interaction of market participants, since that would be rather hard to argue, but instead propose that little is lost in the abstraction, which is presumably helpful in fixing ideas.[17] Yet something is in fact lost: the powerful image of the auctioneer draws attention away from a deep conceptual gap, namely the lack of an adequate account of system dynamics, which foundationally undermines the explanatory relevance of the idea of equilibrium. As Vela Velupillai has established, it cannot be known in advance that any tâtonnement like process could ever work, since that would amount to solving the halting problem of a Turing machine, known to be ‘undecidable’.

Arguably, general equilibrium as typically presented in textbooks is not even a theory of how markets operate in that it doesn’t provide a realistic description of how prices may be formed through the decentralized interactions of agents but rather explores the implications of the existence of alternate sets of given prices. This omission arguably flows from the very concept of equilibrium: if everyone trades at the same prices, then from an individual agent’s perspective it makes no difference what other agents were present in the economy so as to give rise to those prices, or who trades what with whom. However, asking how people will come to trade at equilibrium prices raises deep difficulties, as in the absence of a centralized actor such as the auctioneer it would appear to require not only that each consumer have knowledge of the economy’s characteristics and to compute corresponding equilibrium prices, but also that each consumer assume that others can do the same and trade on that basis. This attributes to every trader “the belief that all traders will converge on price expectations that allow for mutually consistent price-taking behavior economy-wide” (Julius, 2012), which is a very strong assumption.

One way to introduce more realistic models of trading and price formation is to drop the assumption that all market participants face identical prices, or to otherwise allow more agent-specific market processes. These might also include non-optimizing or out-of-equilibrium transactions, even at the cost of permitting minor departures from efficiency (see e.g. Smale, 1976; Foley, 1994; A.J. Julius, 2012). For instance, if it is assumed that market participants make mutually advantageous trades in a random and disorderly fashion (with every feasible mutually advantageous trade having the same probability of occurrence), it is still possible to identify the feasible distribution of agents over offer sets that can be realized in the largest number of ways (although not what will happen to individual agents), i.e. the maximum entropy distribution resulting from market transactions. This is one understanding of statistical equilibrium, and leads to an approximation of Pareto efficiency as well as a kind of stability (Foley, 1994).[18] In a similar fashion A.J. Julius derives the concept of “catallactic equilibrium” to which decentralized trades converge, in which no one is worse off than before trade. Such approaches suggest that even if there are decentralized bargaining processes rather than simultaneous responses to market-wide prices, and even if self-interested agents can only use local information (therefore not necessarily identifying all mutually beneficial transactions in which they can participate), the market may generate efficiency gains, even if it stops short of complete efficiency (i.e. even if it does not exhaust all of the gains that are possible). Although a ‘nearly’ pareto efficient distribution may be expected to be eventually realized, given sufficient time and no destabilizing shocks, the particular distribution that is realized may unlike in the standard theory depend greatly on the specific pathway of trades, which in turn could be influenced by diverse social or institutional factors.

The possibility of non-market clearing and disequilibrium also has macroeconomic consequences explored more extensively in the tradition of non-Walrasian non-tâtonnement theory, perhaps best represented by Malinvaud’s work on disequilibrium unemployment (Malinvaud, 1977), which explores in a general equilibrium framework (and with significantly fixed prices) the possibility of rationing of goods and labor leading to disequilibrium and unemployment.[19]

A respect in which general equilibrium theory remains fundamentally unrealistic is that it takes the economy’s structure as given and has little to say on where technology, preferences, products, or industrial concentration and competition patterns come from, let alone how they change as a result of market processes. An abstract conception of a ‘market’ centered on price-based competition among firms with fixed, freely available and identical technologies is hardly representative of modern capitalism. Understanding how technology and market structure are dynamically shaped by firms through their relations with each other (and with the state and workers) might call for a sociological as well as an economic study of markets (see e.g. Fligstein, 2001). Consumers and workers are both shaped by markets. They do not come to them fully formed (on which see e.g. Piore (1999)). A theory claiming to explain the dynamics of supply, demand, and prices in a whole economy cannot afford to ignore altogether these central topics.

As we know, the firm is viewed by MWG merely as a “black box”, able to transform inputs into outputs. [20] Though it may be argued that this purely technical description of the firm is designed to be generally applicable across a wide range of economic systems, it does so at the cost of providing too thin an empirical description of the productive enterprise to be of much use. The addition of the assumptions of price-taking and profit-maximization does not add much by way of realism.

As Nicholas Kaldor noted, in many markets changes in supply are triggered by “quantity” signals rather than “price” signals. Further, a very large part of a modern industrial economy operates in a context of markets exhibiting a degree of monopoly (Kaldor, 1985) — even if today sometimes on a world rather than a merely national scale, casting some doubt on the empirical validity of the pure price-taking assumption. Non-convexities, such as increasing returns to scale in production, are common in reality, and an important characteristic of modern production. Are the kinds of returns to scale effectively faced by firms determined by factors other than technology as classically understood, e.g. market power in input markets, the “social” dynamics of brand value, or control over ‘intellectual property’? Does the shift in modern economies from traditional manufacturing to information technology enabled services based on social networks, information harvesting and matching (think of Google, Facebook, Twitter or Uber) mean that increasing returns to scale will become more pervasive? Is the idea of a competitive marketplace characterized by price-taking really tenable in the empirical conditions observed in the contemporary world economy, in which there is some evidence of growing market concentration on a world scale? Even if it is a sound assumption, is it because markets are contestable rather than actually contested? These questions must be reflected on in examining the relevance of the general equilibrium framework.

Profit-maximization requires that firms equate marginal cost to market revenue. In convex economies with price-taking firms, this assumption eliminates the issue of market structure, with only aggregate production becoming relevant (not the delineation of individual firms), as profit maximization ensures efficient market outcomes regardless of how production is sited, whether at one global firm or in decentralized units. Although the Second Welfare Theorem can be extended to non-convex economies through the concept of marginal cost pricing equilibrium (which can be interpreted as the equalization of prices to marginal costs without profit maximization [21]), guaranteeing efficient outcomes is not as straightforward.[22] The specific organization of production activities does become relevant, as aggregate output may depend on industrial structure as well as prices, and profit maximization does not always lead to efficient outcomes. Some regulation of firms or other policies may be necessary to avoid the exploitation by firms of their monopoly pricing power at the loss of efficiency. Efficiency is certainly no longer a straightforward property of economic outcomes.

The static characterization of markets also misses crucial insights about the nature of innovative enterprise. General equilibrium theory does not address how a firm (or even a small number of firms) may come to occupy leading positions in an industry through technological superiority. If technology is exogenously given and assumed to be known by all firms, it is left unexplained how technological change is brought about over time (by competing firms innovating in a context of uncertainty, engaging in “real competition” to redefine products and lower cost curves (Shaikh, 1978, 1980; Lazonick 2013, 2015)) [23] or through cooperation among firms and a role of the public sector in providing relevant public goods.[24] In areas such as international trade theory, the static focus of general equilibrium theory may have led to a comprehensive failure to see the larger story – what matters is climbing the ladder of comparative advantage through learning, as opposed to specialization based upon factor proportions.[25] The ongoing process of innovation can include both incremental and ‘paradigm-shifting’ technological shifts, and reflect both path-dependencies and departures from previous paths. Various traditions and schools of thoughts (e.g. Schumpeterian economics, evolutionary economics, the theory of induced innovation) may have much to offer in this area, yet the integration of their insights into general equilibrium theory has been halting (notwithstanding the existence of some such efforts, for instance Aghion and Howitt, 1997 and subsequent work, including in the tradition of DSGE models) perhaps in large part because the conceptually static framework of general equilibrium theory does not provide a ‘natural language’ for making sense of technological change, its sources and its consequences.

Alternative characterizations of what markets are and what market participants seek to do may provide enlightenment. Some sociologists regard markets as social arenas ( “fields”) with both production and exchange structured by legal, social and institutional arrangements. Stable markets are characterized by the sustained presence of producers as “self-reproducing role structures” (White, 1981). In this line of analysis firms are primarily driven by survival (or reproduction) rather than profit maximization. Ensuring firm survival in a context of uncertainty may require actions on multiple fronts when firms face difficulties in such things as finding suppliers (who may be able to ‘hold up’ by raising prices and controlling supply of inputs), maintaining and gaining customers (through market research and advertising, brand management, and product or distributional innovation), and extracting cooperation from managers and workers within the firm. Arguably some steps taken by firm owners and managers may make more sense when understood in term of their goal of managing these various sources of uncertainty (and maintaining stable markets) rather than in term of profit maximization alone (Fligstein, 2001).

This perspective might also be helpful in understanding market concentration. The emergence of large firms as factors in advanced capitalism did not arise only from higher profitability of investment in such firms, but also from the risk reducing benefits of size; large firms face a lower risk of failure and their profit rates are less volatile than smaller firms (Edwards, 1979: 84). [26] Pricing may be shaped by the need to maintain a regular clientele or improve market share in order to safeguard long-term survival probabilities and option value. This may also explain, for example, why it is possible that goods continue to be produced even if sold below cost (because stopping production could potentially lead large firms to bankruptcy), as was noted by the iconic 19th century American businessman Andrew Carnegie who wrote that in these situations “the article is produced for months and, in some cases that I have known, for years, not only without profit or without interest on capital, but to the impairment of the capital invested…” (cited in Edwards, 1979: 41). As Mehrling (2010) has recently argued, the maintenance of liquidity in order to meet a survival constraint can be a much more important short and medium term consideration than the maximization of profit. The perspective of firms as driven by survival may have significant implications as regards their behavior, in particular in times of adversity. It may also explain why many institutions take actions that reduce immediate profitability. For example, the conversion of Goldman Sachs and Morgan Stanley to Bank Holding Companies in the last financial crisis entailed significant internal restructuring costs due to regulatory requirements, such as deleveraging the balance sheet and reducing proprietary trading. This move can only very indirectly be interpreted in terms of maximization of expected profits, whereas it can be understood very directly in terms of managing funding liquidity risk (amongst other things ensuring access to the Federal Reserve lending facilities) in a period when credit markets froze and the Federal Reserve found itself serving as the dealer (rather than lender) of last resort, to ensure the liquidity of securities markets (Mehrling, 2010). The lack of survival constraint is an element of the lack of realism of general equilibrium theory that applies not only to firms but indeed to people, who in real life can cease to exist due to starvation (and indeed to become decreasingly productive as they come close to that point) but in general equilibrium theory have generally assumed to be impervious to such weaknesses (see Sen, 1990, although as noted in footnote 6 above, there have been some efforts to remedy that lack).

This brings us to another point. Why and how might such intervention be needed? Why and when do markets break down? Here the framework of general equilibrium seems particularly unhelpful because of its failure to provide what Keynes called a monetary theory of production (Keynes, 1933). Money is only used as a transitory and neutral link in exchange transactions (making for what Keynes called a real-exchange economy). Further, though commodities can be distinguished by when and where they are delivered, as well as by a specific state of nature (Arrow-Debreu securities), finance is not explicitly modeled as a stand-alone sector having its own dynamics but rather as always tied to fundamentals in the form of the valuation of underlying assets. However, financial crises can only be credibly analyzed if money and financial markets are understood as playing a role of their own, affecting the actions and motivations of market participants. The possibility of bubbles arising (whether due to rational or irrational exuberance) is an intrinsic feature of asset markets that is not straightforward to rule out in theory (see e.g. Burgstaller, 1994; Shiller, 1981, 2000; and more generally the literature on rational and irrational bubbles such as for instance Blanchard and Watson, 1982; Brunnermeier, 2001), let alone in practice. While general equilibrium theory has provided some of the abstract justification for the supposedly efficiency-enhancing role of certain derivatives markets, it has done relatively little to take into account their actual evolution and the increasing recognition that they may be potentially destabilizing. For instance, markets for future deliveries of goods are created on the basis of participants’ expectations regarding a given set of future states of nature. However, there is a further distinction to be made between those assets that are conditional on events that are external to the system (e.g. storm insurance), as opposed to financial securities where payments are linked to economic variables determined within the system itself (such as prices and quantities). This, according to Kenneth Arrow, a seminal figure in the extension of general equilibrium theory to contingent claims markets, is one of the reasons that general equilibrium theory does not guarantee efficient outcomes of securities markets trading, nor rule out financial instability (see Arrow (2009)). The existence of contingent commodities for every possible state of the world is in any event unlikely due to the presence of radical uncertainty. As the literature on incomplete contracting (e.g. Hart (1995)) has underlined, it is impossible to anticipate all contingencies, including ones that may have significant implications.

There have been some recent efforts in the economics and finance literature to take note of the micro-structure and processual dynamics of financial markets and to integrate this knowledge into broader theorizing (see e.g. Greenwald, E. and Stiglitz, 1984; Magill and Quinzii, 1996; Hens and Pilgrim, 2003) but the many different ways in which this can be done highlights that general equilibrium theory does not in itself offer much insight. That is rather contributed by specific observations or assumptions about the structure and workings of the markets concerned, for which general equilibrium theory can provide a broader theoretical reference point (or not). Among the features of financial markets to be taken into account in order to understand contemporary advanced economies are the factors affecting the ‘liquidity’ of securities, the role of market structures and practices (such as algorithmic or index-based trading, the sequence of bids and asks, order queuing and execution, data dissemination, etc., see Mirowski, 2004), the role of behavioural and social factors in trading dynamics, the impact of actual or potential regulation, as well as the perceived hierarchy of money and credit (Mehrling, 2010).

Theory and Reality

Even as areas of application that refer to it (such as DSGE modeling) have become areas of intensive research, general equilibrium theory itself has ceased to be an active area of research, perhaps for the reason that what could be said within its limits has largely been said, even as it maintains areas of theoretical inadequacy, some of which are even in theory unresolvable. To the extent that applied modeling requires adding substantive and substantial auxiliary assumptions, it is not wholly evident that much specific benefit is provided by deference to the general equilibrium framework. That choice sometimes looks like the decision to write a diplomatic note in French because it is the “language of diplomacy” rather than due to any intrinsic necessity. Sidestepping the stylistic and grammatical conventions of standard general equilibrium theory may have advantages in terms of freeing the mind. This may be true even if there is nothing “wrong” with it when it is understood as a formal system. There may in contrast be much that is wrong with it when its external correspondence with the world, and usefulness in illuminating it, are the concerns.

The ways forward may be many. We have emphasized the need throughout our blog entries for a greater concern with history [27], institutions, politics, culture and norms, all of which can only be learnt about through diverse evidence-gathering methods. These in turn must be folded into economic analysis in creative ways[28]. Regardless of the framework adopted, there is a need for more realistic descriptions of the actors and their acts, so as to make for a better economics. We need accounts of human motivation, for instance that are not solely focused on the consumption of commodities but which encompass human interest in the nature of work and interactions (see e.g. Frank, Gilovich and Regan, 1993 and Skidelsky, 2012) or that do not involve implausible premises concerning agents’ hyper-rationality (e.g. that suppose an ability to look into the far future or to solve complex models[29]). We need accounts of the firm that are more grounded in empirical observation and thus characterize it more adequately, for example by taking into account such factors as the goal of firm survival, the separation of control rights and ownership rights, and the diverse dimensions of inter-firm competition — going beyond price-based competition to encompass technological innovation, marketing and brand management, control of data and networks and many other dimensions. There is also a need to explicitly incorporate social interactions and norms, as well as the role of institutions and the state — not merely in background enforcement of contracts, but as factors influencing the day-to-day functioning of markets (for example, who gets to strike what bargains with whom and under what terms). The idea of production being separated from distribution must also be revisited, as the concept of the lump-sum tax is a myth, and in real economies that are caught in time, every before is an after. Instead, production systems must be analyzed from the first with an eye to their distributional implications (shaped by both ex-ante and ex-post redistribution possibilities). Theory must confront reality, acknowledging that the former cannot exist in splendid isolation. Parsimony is a virtue, but not the only one (and it cannot be claimed that general equilibrium theory, the reigning theoretical paradigm, is especially simple!).

For a student of real world markets, general equilibrium theory appears strangely distant. It is not surprising that a highly abstract framework consisting of hyper-rational agents might be ill equipped to provide a sufficiently credible account of markets in modern capitalism. What is more surprising is that despite these obvious limitations (some even claim that general equilibrium has been “dead” [30] since the Sonnenschein-Mantel-Debreu results in the 1970s) the framework is still central to the Ph.D. curriculum, and continues to play a preeminent role in the high theory of economics. To the extent it shows the limits of the way of thinking, this is fair enough, but that is not how the subject is approached, by MWG or any other major text. Is this an example of the greater importance given in our ‘science’ to the rites of justification than to the task of explanation? When a way of thinking limits our thinking then it’s time, with due appreciation for those who built it, to ‘throw away the ladder’.

[1] This notion, however, is based on a broader interpretation of Smith’s reference to the invisible hand than can easily be sustained. Some historians of economic thought even argue that Smith used the term in a fashion that was ‘ironic’ (see e.g. https://en.wikipedia.org/wiki/Invisible_hand).

[2] So-called dynamic stochastic general equilibrium (DSGE) models bring these two ideas together, by representing the idea of ‘micro-founded models’ that are also potentially possible to ‘calibrate’ against real data. See for instance V.V. Chari’s testimony to the US House of Representatives (Chari, 2010).

[3] ‘Pareto efficiency’ may not even ensure the survival of all consumers. As Amartya Sen underlines, massive starvation may well be an outcome of market processes that satisfy the requirements of the first theorem (Sen, 1981). Some recent literature has attempted to incorporate the possibility of non-survival of agents into general equilibrium theory. See e.g. Coles and Hammond (1993), Hashimzade and Majumdar (2005) and Majumdar and Hashimzade (2003).

[4] It is not altogether obvious why a social planner may not engage in a direct redistribution policy to sustain the desired outcome, as opposed to reallocating initial endowments ex ante (and letting the market reach the desired distributional outcome). If there are intrinsic merits to market-based processes (other than as a procedural “nicety”), those are not clearly articulated.

[5] See Starr (1969), applying an extended version of the Shapley-Folkman lemma, which sets a bound on the distance between the Minkowski sum and its convex hull to characterize the approximation. Non-convex production sets are replaced in this analysis by their convex hulls.

[6] For a fuller review of the implications of this deeply negative result on the subsequent development of general equilibrium theory, see Rizvi (2006).

[7] As argued, for instance, by Kirman (1989: 126-7).

[8] In a regular economy the excess demand function has the property that its slope at any equilibrium price vector is not equal to zero.

[9] See Dierker (1972), Kehoe (1979, 1980, 1985).

[10] There is only one equilibrium if the initial endowment happens to be a Walrasian equilibrium.

[11] Technically, the weak axiom only establishes that the set of equilibria vectors is convex. If there is only a finite number of equilibria, this entails uniqueness.

[12] In an economy with a production side, gross substitutability is neither necessary nor sufficient to ensure uniqueness. The supply side must be an input-output system (Kehoe, 1985).

[13] Global stability entails that the dynamic trajectory causes the price vector to converge to an equilibrium regardless of the starting point. Local stability is the more stringent requirement that it converge to an equilibrium point if removed from it but remaining within a “neighbourhood”.

[14] As such, existence theorems provide non-constructive rather than constructive proofs of the existence of equilibrium, so that the equilibrium is strictly speaking not computable (Velupillai, 2005) contrary to the claims of ‘computable general equilibrium theory’.

[15] Only in special cases such as when the economy has the structure of an input-output model with two scarce factors can all equilibria be exhaustively identified (Kehoe 1984, 1985). See also the preceding footnote, on computability of general equilibrium.

[16] Prices are lowered for goods with excess supply and increased for goods with excess demand.

[17] Ironically, a highly centralized abstraction plays a key role in what many interpret as a theory of the operation of free markets!

[18] Stationarity of prices is achieved in the presence of ongoing trades, though not all possible beneficial trades are exhausted at any given moment, thereby failing to implement fully a Pareto optimal allocation. However, the market approximates Pareto efficiency because agents tend to concentrate at minimum cost points on their indifference surfaces.

[19] See also Drèze (1987) and Marglin (forthcoming) on non-price adjustment mechanisms.

[20] See our prior blog entry, The Theory of the Firm: Language, Model and Reality.

[21] An efficient allocation can be supported by a price vector orthogonal to consumers’ indifference curves and to the production set’s frontier. This can be interpreted in terms of the equalization of prices to marginal costs, under an assumption of convexity of the input set, and provided that the concept of a normal cone is used for production sets. See Guesnerie (1975), Bonnisseau and Cornet (1990).

[22] The marginal cost pricing rule might result in losses rather than profit for some non-convex firms. The issue of how to allocate profits and losses of the firms between agents becomes salient, as it can no longer simply be assumed that profit and losses will be allocated to consumers on the basis of fixed ownership shares. The problem becomes one of redistribution of income from the private to the public sector so as to finance public deficits. A traditional solution is to use lump-sum taxation – if that fabled beast of burden should be available — to cover the losses of non-convex firms. Whether an efficient allocation could be supported by a two-part tariff to finance public deficits is still an open question (Quinzii and Parthasarathy, 1992).

[23] Lazonick’s critique is precisely that the entrepreneurial firm does not passively accept the condition of increasing costs as a constraint, but rather makes strategic investments to take control of the cost structure.

[24] On the cooperative as well as competitive aspects of learning in industry, see the various writings of Charles Sabel. For a study of the role of government in fostering innovation, see Mazzucato (2013).

[25] On this point see e.g. Stiglitz and Greenwald (2014) and Unger (2007).

[26] This is presumably true of financial institutions that are “too big to fail”, if for political rather than merely economic reasons. The lack of modeling of the pervasive soft budget constraint in capitalism (see Cui (1994) is another feature of the unrealism of the stylized general equilibrium framework.

[27] See for instance Joan Robinson’s helpful distinction between logical and historical time (Robinson, 1962). Logical time characterizes the different properties underpinning the neoclassical framework, where time is seemingly absent from the analysis (lying at “right angles to the page”), infinitely divisible, and where agents form perfect expectations of the future, where technology is fixed, and the future no different from the past. This is to be contrasted with properties closer to actual experience – what Robinson calls “historical time”, which is characterized by path dependency, technical progress, stickiness, uncertainty and imperfect knowledge, etc. See also the discussion in Harris, 2004.

[28] Agent-based modeling or other approaches for analyzing the evolution of economies that do not rely on the idea of equilibrium but nevertheless have a determinate character provide one possible avenue of exploration.

[29] See the biting critique and development of possible alternatives by Shaikh (2015).

[30] See Ackerman (1999).

- 1. Ackerman (1999). "Still Dead After All These Years: Interpreting the Failure of General Equilibrium Theory". Working Paper No. 00-01, Tufts University, Global Development and Environment Institute.

- 2. Aghion, P. and Howitt, P. (1997), Endogenous Growth Theory. The MIT Press.

- 3. Arrow, K.J. (2009). "Economic Theory and the Financial Crisis". Unpublished manuscript of keynote address, Beijing Forum, November 6th, 2009 (available at http://ac.els-cdn.com/S1877042813004928/1-s2.0-S1877042813004928-main.pdf?_tid=2f32137c-b1c1-11e5-810f-00000aab0f6c&acdnat=1451788078_252ce9ef0bf176304e0dffb99e94b0af)

- 4. Blanchard, O. J., and M. W. Watson (1982). "Bubbles, Rational Expectations, and Financial Markets", in Crisis in the Economic and Financial Structure, ed. by P. Wachtel, pp. 295-315. Lexington, MA.

- 5. Bowles, S. (2004). Microeconomics: Behavior, Institutions and Evolution. Princeton University Press.

- 6. Bonnisseau, J.M. and Cornet, B. (1990). "Existence of Marginal Cost Pricing Equilibria in Economies with Several Nonconvex Firms." Econometrica 58(3): 661-82.

- 7. Brunnermeier, M. K. (2001). Asset Pricing under Asymmetric Information: Bubbles, Crashes, Technical Analysis and Herding. Oxford University Press.

- 8. Burgstaller, A.C. (1994). Property and Prices. Cambridge University Press.

- 9. Chari, V.V. (2010). Testimony before the Committee on Science and Technology, Subcommittee on Investigations and Oversight, U.S. House of Representatives, available at http://people.virginia.edu/~ey2d/Chari_Testimony.pdf

- 10. Coles, J.L. and P.J. Hammond (1993), "Walrasian Equilibrium without Survival: Existence, Efficiency and Remedial Policy", available on http://homepages.warwick.ac.uk/~ecsgaj/NonSurv.pdf

- 11. Cui Zhiyuan (1994),"Can Privatization Solve the Problem of Soft Budget Constraint?" in Vedat Milor (ed.), The Political Economy of Privatization and Public Enterprise Reform in Eastern Europe, Asia, and Latin America, Boulder: Lynne Rienner.

- 12. Dierker, E. (1972). "Two Remarks on the Number of Equilibria of an Economy". Econometrica. XL: 951-53.

- 13. Drèze, J. (1987). "Underemployment equilibria. From Theory to Econometrics and Policy" . European Economic Review 31(1-2):9.

- 14. Edwards, R. (1979). Contested Terrain: The Transformation of the Workplace in the Twentieth Century. Basic Books.

- 15. Foley, D. (1994). "A Statistical Equilibrium Theory of Markets." Journal of Economic Theory 62(2): 321-45.

- 16. Frank R., Gilovich T. and Regan D. (1993). "Does Studying Economics Inhibit Cooperation?" Journal of Economic Perspectives. 7(2): 159–71.

- 17. Guesnerie, R. (1975). "Pareto Optimality in Non-Convex Economies." Econometrica 43(1): 1-30.

- 18. Greenwald, E. and Stiglitz, J.E. (1984). "Externalities in economies with imperfect information and incomplete markets". Quarterly Journal of Economics 101: 229-264.

- 19. Hahn, F. (1988). "On Market Economies". In Skidelsky, R., editor, Thatcherism. Basil Blackwell.

- 20. Harris, 2004. Joan Robinson on "History versus Equilibrium" available at http://www-siepr.stanford.edu/workp/swp04005.pdf

- 21. Hart, O (1995). Firms, Contracts, and Financial Structure. Oxford: Oxford University Press.

- 22. Hashimzade, N .& Majumdar, M. (2003). "Survival Under Uncertainty in a Random Exchange Economy". In Institute of Mathematical Statistics Lecture Notes/Monograph Series. Athreya, K., Majumdar, M., Puri, M. & Waymire, E. Beachwood, OH: Institute of Mathematical Statistics. 187-208.

- 23. Hens, T. and Pilgrim, B. (2003). General Equilibrium Foundations of Finance: Structure of Incomplete Markets Models. Springer.

- 24. Julius, A.J. (2012). Class in Catallaxy, available at http://www.ajjulius.net/papers/ff.pdf

- 25. Kaldor, N. (1985). Economics Without Equilibrium. M.E. Sharpe

- 26. Kehoe, T. (1979). "Regularity and Index Theory for Economic Equilibrium Models". Ph.D. thesis, Yale University.

- 27. Kehoe, T. (1980). "An Index Theorem for General Equilibrium Models with Production". Econometrica, XLVIII: 1211-32.

- 28. Kehoe, T. (1984). "Computing All the Equilibria of Economies with Two Factors of Production". Journal of Mathematical Economics 13(3): 207-223.

- 29. Kehoe, T. (1985). "Multiplicity of Equilibria and Comparative Statics". The Quarterly Journal of Economics 100(1): 119-147.

- 30. Kirman, A. (1989). "The Intrinsic Limits of Modern Economic Theory: The Emperor Has No Clothes". Economic Journal, Vol. 99: pp. 126–39.

- 31. Lazonick, W. (2013). "The Theory of Innovative Enterprise: Methodology, Ideology, and Institutions", in Jamee K. Moudud, Cyrus Bina, and Patrick L. Mason, eds., Alternative Theories of Competition: Challenges to the Orthodoxy, Routledge.

- 32. Lazonick, W. (2015). "The Theory of Innovative Enterprise: Foundation of Economic Analysis". The Academic-Industry Research Network, Working Paper #13-0201.

- 33. Malinvaud, E. (1977). The Theory of Unemployment Reconsidered. Halsted Press.

- 34. Magill, M. and Quinzii, M. (1996). Theory of Incomplete Markets, Vol. I, The MIT Press.

- 35. Majumdar, M. & Hashimzade, N. (2005). " Survival, Uncertainty, and Equilibrium Theory: An Exposition". In Essays in Dynamic General Equilibrium Theory: Festschrift for David Cass. Citanna, A., Donaldson, J. & et.al. Springer. 20:107-128.

- 36. Marglin, S. (forthcoming), Raising Keynes: A 21st Century General Theory, Cambridge, MA: Harvard University Press.

- 37. Mazzucato, M. (2013). The Entrepreneurial State: Debunking Public vs. Private Sector Myths, Anthem Press.

- 38. Mehrling, P. (2010). The New Lombard Street: How the Fed Became the Dealer of Last Resort, Princeton: Princeton University Press.

- 39. Mirowski (2004). "Markets Come to Bits: Evolution, Computation and Markomata in Economic Science", available at http://www.uq.edu.au/economics/PDF/int/Mirowski.pdf

- 40. Quinzii, M. and S. Parthasarathy (1992). Increasing Returns and Efficiency. Oxford: Oxford University Press.

- 41. Rizvi, A. (2006). The Sonnenschein-Mantel-Debreu Results after 30 Years. History of Political Economy (2006) 38 (Suppl 1), 228-245.

- 42. Robinson, J. (1962). Essays in the Theory of Economic Growth. London: Macmillan

- 43. Scarf, H. (1960). Some Examples of the Global Instability of the Competitive Equilibrium" International Economic Review 1(3): 157-172.

- 44. Scarf, H. (1973). The Computation of Economic Equilibria. Yale University Press.

- 45. Sen, A. (1981). Poverty and Famines: An Essay on Entitlement and Deprivation, Oxford University Press.

- 46. Shaikh, A. (1978). "Political Economy and Capitalism: Notes on Dobb's Theory of Crisis". Cambridge Journal of Economics 2(2):233.

- 47. Shaikh, A. (1980). "Marxian Competition versus Perfect Competition: Further Comments on the So-Called Choice of Technique". Cambridge Journal of Economics 4(1): 75.

- 48. Shaikh, A. (2015). Capitalism: Competition, Conflict and Crises. Oxford: Oxford University Press.

- 49. Shiller, R. (1981). "Do Stock Prices Move Too Much to be Justified by Subsequent Changes in Dividends?" American Economic Review 71(3): 421-36.

- 50. Shiller, R. (2000). Irrational Exuberance, Princeton University Press.

- 51. Smale, S. (1976). "Exchange Processes with Price Adjustment". Journal of Mathematical Economics 3:211-26.

- 52. Sonnenschein, H. (1973). "Do Walras' Identity and Continuity Characterize the Class of Community Excess-Demand Functions?" Journal of Economic Theory 6: 345–354.

- 53. Skidelsky, R. and Skidelsky, E. (2012). How Much is Enough? Money and the Good Life. Other Press.

- 54. Starr (1969). Quasi-Equilibria in Markets with Non-Convex Preferences, Econometrica 37(1): 25–38.

- 55. Stiglitz, J,E. and B. Greenwald, B.C. (2014), Creating a Learning Society: A New Approach to Growth, Development and Social Progress, New York: Columbia University Press.

- 56. Unger, R.M. (2007), Free Trade Reimagined: The World Division of Labor and the Method of Economics, Princeton: Princeton University Press.

- 57. Velupillai, V. (2005). "The Foundations of Computable General Equilibrium Theory", Working Paper No.93, Department of Economic, National University of Ireland, Galway (available at http://.www.economics.nuigalway.ie/index/html)

- 58. White, H. (1981). "Where Do Markets Come From?" American Journal of Sociology 87(3): 517-47.