There are two basic ways to hold fixed the exchange rate between the money of two communities: peg the exchange rate or create a monetary union.

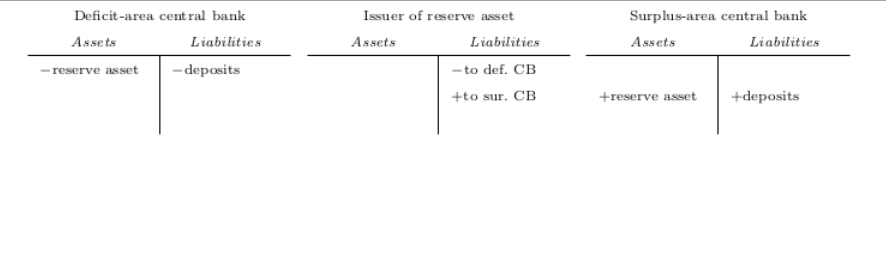

With an exchange-rate peg, typically one central bank targets the price of some reserve money against its own liabilities. To fix ideas, focus on a surplus central bank resisting appreciation. Any net inflows purchases of domestic money for reserve money would lead FX dealers to bid up the exchange rate, so to hold the peg the central bank must meet the demand for domestic money on its own balance sheet, by buying the reserve money coming in and issuing new domestic money. On the central bank’s balance sheet, shown also with the deficit-area central bank and the issuer of reserve money, the transaction looks like this:

What about a monetary union? At first blush it seems completely different. The real essence of a monetary union is to ensure that money is money, anywhere within the union. A dollar deposited in San Francisco extinguishes a dollar of debt in New York. A euro deposited in Athens extinguishes a dollar of debt in Berlin, at least for now.

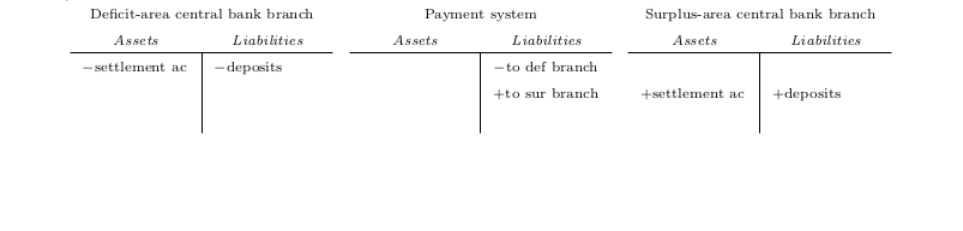

This is guaranteed by the payment system. If far-flung banks cannot settle a payment bilaterally, they can go through a series of trusted intermediaries, the district FRBs in the US or the national central banks in the eurozone. To complete payments, these central bank branches maintain clearing liabilities among themselves. A payment through such a system is shown here in balance sheets:

The first point is that the balance sheets for a monetary union have a structure identical to those for an exchange-rate peg. The important part is that in both cases, the liabilities of a trusted intermediary provide the mechanism to clear payments across the system.

The second point is that, though the balance-sheet structures are the same, the two systems differ significantly because of what might be thought of as the reversibility of the peg. So long as domestic money has its own name, and local debts are denominated in it, the peg can be exited unilaterally. But in a monetary union, domestic money loses its identity, and exit may become much more complicated.