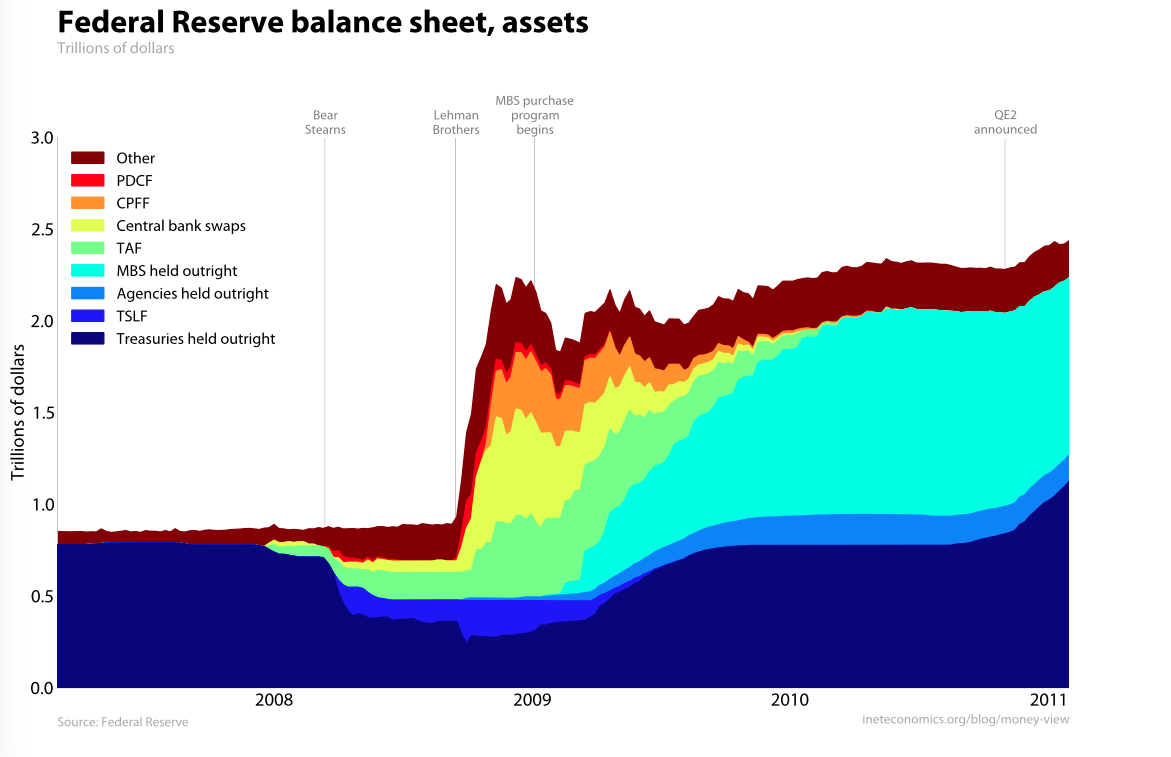

Here’s the Fed’s balance sheet, asset side first:

Though the financial crisis and its many liquidity programs are receding into history, its aftershocks still reverberate, in employment and output and, no less so, on the Fed’s balance sheet. QE2 dominated 2011, giving way late in the year to the re-emergence of the central bank liquidity swaps to provide liquidity support to the ECB. The graph shows what I normally consider to be the inflection points in Fed policy-making. Whether the swaps turn out to be a blip or another inflection point remains to be seen.

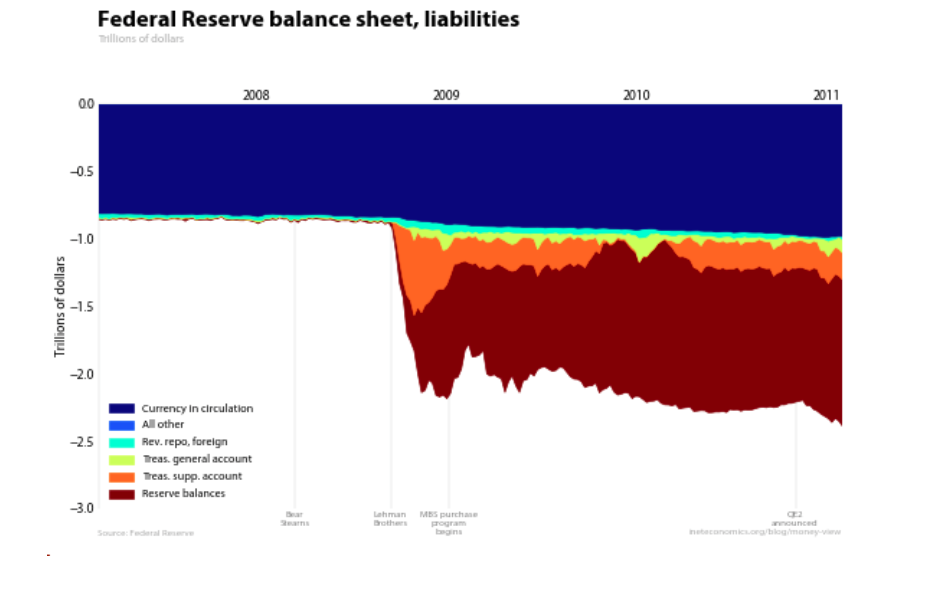

On the liabilities side, we see that the expansion continues to be financed by an expansion of reserves. A quick point, to be expanded upon in a future didactic post: the Fed chooses the size of this reserve position, not the banks, and it is not an indication of hoarding or refusing to lend. Lending shifts reserve deposits among banks, but leaves the overall position unchanged. (FT Alphaville has been careful about the same issue on the ECB’s balance sheet.)

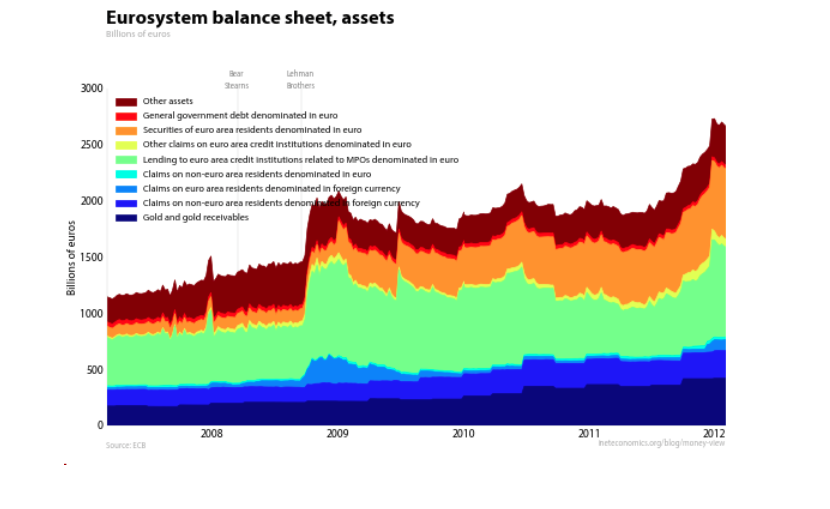

Meanwhile, across the Atlantic:

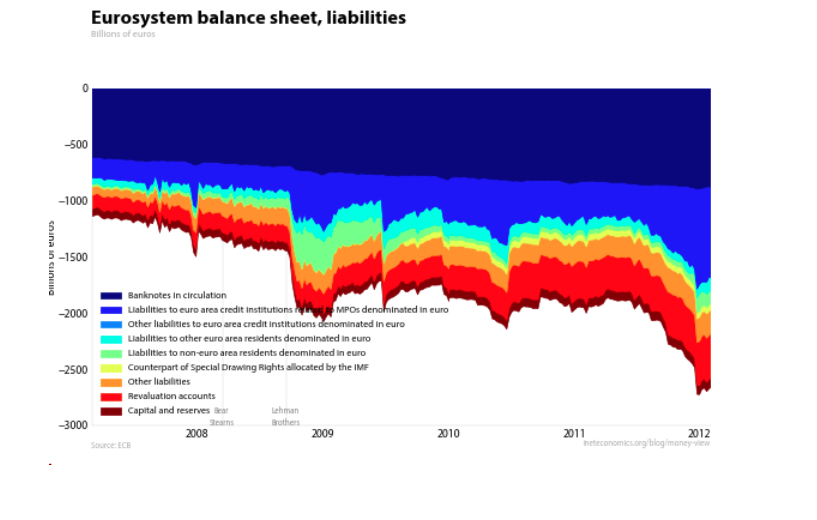

I sometimes find it difficult to parse the Eurosystem balance sheet, but December’s LTROs are easy to spot, to the right. By all accounts these operations eased the strains around year-end, but imbalances continue to accumulate in the payments system, and it is not yet clear how they will be unwound. In that vein, this final chart I find most interesting for what it omits: the intra-Eurosystem claims that get netted out in consolidation.

These issues remain live, and we continue to follow them. More to come.