The speed and duration of COVID-19 economic recovery will depend on how the government will finance emergency programs.

The Covid-19 pandemic is now affecting most countries of the world, and governments are attempting to mitigate the crisis with public health measures involving restrictions on the movement of people and their work. These measures have drastically reduced economic activity, despite the dramatic increase in traffic in the health sector and government measures to assure minimum consumption, and to compensate firms for the collapse of their cash flows.

As the scale of the economic contraction becomes apparent, there have been calls for governments to undertake additional measures to prevent the emergence of another Great Depression. This paper examines the way in which the financing of the coronavirus crisis will affect any economic recovery. While we focus upon the case of the United Kingdom, we believe that the structural factors identified in the paper, in particular the debt structures and their consequences, may be common to market economies elsewhere.

The economic impact of the Covid-19 crisis may be divided into two parts. The first, out of which we hope to emerge sometime this year, is the immediate impact of the medical emergency and government attempts (with varying degrees of success) to reduce infection rates. These have caused the unprecedented reduction in economic activity in virtually all countries of the world, whether due to sickness, or government-imposed closure, or restrictive conditions of work.

The scale and duration of this impact in particular countries depends not only on the medical infection, but also on the effectiveness of government policy. The second part of the economic impact, coming after the first, will be the economic recovery after the medical emergency. This paper argues that the speed and duration of this recovery depends not so much on the willingness of governments to remove restrictions on business activity, allowing the economy to resume some ‘natural’ general equilibrium or growth path, as on the financing of the emergency measures. It is this financing that will create the debt structures which the economy will need to service and which will therefore constrain economic activity in the future.

Section 1 that follows outlines the financing options and their likely economic consequences. Section 2 outlines a financing and expenditure package that we believe will ensure the most rapid economic recovery.

1. The Financing Options

Government expenditure in the UK has risen dramatically to pay for medical supplies, National Health Service (NHS) staff and welfare payments, while tax revenues have fallen off with restricted consumption and incomes. After the pandemic, levels of government expenditure should be maintained to support cash and income flows in the private sector. A fixation on reducing fiscal deficits or government debt, just because the medical need has fallen, will hobble the economic recovery and frustrate the intended reduction in debt. The crisis and financial stability in the recovery require public sector deficits and debt to maintain expenditure and income flows. For reasons given below, it would be irresponsible to place the immediate financing burden of the crisis and the recovery entirely on households and firms.

Part of any budgetary resources freed up by the eventual reduction of expenditure on Covid-19 should obviously go towards clearing the backlog of medical and surgical treatment that has been deemed ‘inessential’ in the crisis. We should not return to the previous approach to health care in which people in need of care, including cancer patients, are treated as ‘spare capacity’ in the health service and forced to wait for treatment. Another part of the budget can be redirected towards expanding expenditure on housing, social services, care for the elderly, and further education, all of which have suffered severe cuts since 2010. This will help to avoid the worst of the recession and go some way towards alleviating the impact of the crisis on inequality and deprivation.

How can this expenditure be financed? There are essentially four ways in which such a large expenditure may be be financed

First of all, the obvious way that will appeal to fiscal conservatives is by raising taxes. However, the amounts that can be raised by taxation are inevitably limited, and the prospects for a balanced budget are unrealistic. The crisis is a financial crisis not only because business activities have been reduced during the emergency, but also because its cost exceeds the money that may be raised in taxation at the time of the crisis without further reducing economic activity and impeding the recovery.

A second, more spontaneous solution is what is already happening: the expansion of private debt. This is augmented by a third measure, the expansion of public borrowing. The fourth way of financing the crisis is by monetising the government deficit.

Private debt

The role of private debt requires some further explanation, because it plays a pivotal role in any economic recovery. The usual way in which households, firms, banks and public institutions supplement the inadequacies in their income is by running down savings, selling assets or borrowing money. Those with assets may be smart enough to borrow against their assets (with lower financing costs, compared to unsecured borrowing). But in those parts of society where savings are modest and few marketable assets are possessed, among poorer households and small, and even some medium-sized, enterprises the only option may be borrowing. This is the traditional way in which gaps in welfare or charitable provision have been filled.

If the government did nothing other than restricting movement and providing the health services, the financing of the crisis would involve a huge rise in private debt. With bills to pay and faced with a loss of income and no replacement of that income from the government, households and firms will turn to borrowing formally from banks, or informally from suppliers or landlords with postponed payments or rents. But this is not the debt that economists talk and write about in economics books, where people borrow in order to invest. Crisis debt, or ‘forced indebtedness’ has no economic purpose other than survival. It has not been incurred in order buy any asset. It drains future cash flow and makes creditors reluctant to lend, precisely because there is no asset to provide a future income out of which the debt could be repaid (hence the need for government guarantees).

Therefore, to maintain their credit standing, borrowers of emergency private debt will seek to repay that debt in the recovery. They will do so by raising prices and holding down their expenditure. The greater the debt incurred by private firms and the self-employed for the purposes of maintaining their payment commitments during the crisis, the greater will be the subsequent debt deflation – holding down expenditure on employees and suppliers in order to pay down outstanding debt – inhibiting the post-crisis recovery in employment. The greater is the reliance on private sector debt arrangements, the greater will be the desire of private sector firms and the self-employed to raise prices in order to recover a large enough cash flow to allow for the repayment of crisis debt.

This is not just a question of the debt facilities that are being guaranteed by the government through the commercial banking system. Reliance on private debt will permeate the whole economy with formal and informal debt. It could be postponed rent or mortgage payments, or borrowing from friends and associates, or extended credit terms on retail or wholesale payments, or the vouchers that airlines are offering in compensation for cancelled flights. These are all future financial obligations whose only purpose is surviving a period of income deficiency, rather than to secure a future income.

The dangers of inflation, combined with falling real wages as prices rise, will slow the economic recovery into the kind of stagflation that hit Britain during the late 1970s, with disastrous economic, social and political consequences. Avoiding such an outcome means relying on the government to finance the crisis and the recovery from it. However, the government too has been hit by a drastic fall in its revenues. Thus, financing the crisis means relying on deficit financing on a scale unknown in modern times.[1]

Government borrowing will therefore be necessary to overcome the crisis. The Office of Budget Responsibility estimates that public sector borrowing will increase by £229 billion as a result of the crisis, with public sector net debt rising to over 100% of GDP on a financial year basis.[2] The Institute for Fiscal Studies has noted that a public sector deficit of £200 billion this year is “well within the bounds of possibility,” and the Institute for Government has made a similar argument.[3]

These deficits can be financed in two ways: monetisation or the issuance of government debt. We will discuss these options in turn.

Monetising the deficit

At the time of writing, the Bank of England has announced a temporary extension to the Ways and Means facility, which is essentially the government’s overdraft facility at the Bank.[4] Since the Bank of England is a public sector body, government spending financed by the Ways and Means facility is a way of financing government expenditure by creating bank reserves. However, the extension is only meant to provide a temporary source of short-term liquidity, primarily for the purposes of cash-flow smoothing.

Monetising the public sector deficit adds to the bank deposits circulating in the economy. The normal processes of production and exchange tend to concentrate such deposits in the bank accounts of larger businesses and the banks that hold those accounts. This will add to the growing liquidity of the banking system in the form of the ‘forced saving’ of middle class households ‘working from home’ and deprived of consumption opportunities.

This growing liquidity could be considered an inflationary threat, and the Bank of England has in fact made clear that it opposes monetisation of the deficit. To some degree this is a residual adherence to the monetarist doctrine, according to which an increase in the money supply is inflationary. A more realistic threat is that highly liquid balance sheets alongside a shortage of safe domestic assets would lead to a flight to dollars. The resulting depreciation of sterling, by making imports more expensive, would then bring about the feared inflation.

So far, such a depreciation has been avoided through the exercise of foreign currency swaps by the US Federal Reserve. These are arrangements by which the Federal Reserve enters into agreements with other central banks to swap US dollars against currencies issued by other central banks (mainly the European Central Bank and Japan, but also Mexico and South Korea).

The Bank of England has access to such swaps. Under the terms of the swaps, the initial swap is reversed at an agreed date in the near future, usually three months later, at the same exchange rate. From March until the end of the first week in June, a total of $447 bn had been swapped, compared to $583 bn at the height of the American financial crisis in December 2008. These swap facilities have kept exchange rates stable through the pandemic. But they effectively give the US Federal Reserve the right to determine exchange rates for the currencies swapped. In the case of the UK, it means that it is the Federal Reserve that determines the ability of the Bank of England to hit the inflation target that is supposed to guide the Bank’s monetary policy.[5]

In addition to this dependence on the Federal Reserve, Britain’s exchange rate management is complicated by the imminent agreement that the British Government is supposed to reach with the European Union on the terms of future trade with Europe. Large scale monetisation would ensure that any set-back in these negotiations, or the brinkmanship that the British government is using to burnish its achievements in them, causes extreme shifts in liquidity between financial markets.

On the other hand, monetisation of the fiscal deficit is useful to relieve liquidity pressures in the bond market. Moreover, insofar as it facilitates the retirement of private debt, it could even alleviate inflationary pressure. This is because the situation discussed above, in which ‘forced indebtedness’ induces firms to attempt to pay off debts by raising prices, can be mitigated to some degree by increases in cash-flow. If private debt is retired in this way, at the same time as the government issues bonds, then monetisation could facilitate the conversion of private debt into public debt.

However, the condition for this to occur is that government expenditure expands the cash-flow of over-indebted businesses and households. This means that, for monetisation to work effectively, government expenditure needs to be targeted at those households and firms that have accrued crisis debts. To some degree this has happened with grant assistance to the self-employed and wage subsidies.

Government borrowing

In comparison to monetisation, the sale of government bonds has the advantages of absorbing the excess liquidity in the banking system built up during the crisis and increasing the stock of safe sterling-denominated assets for intermediaries and institutional investors. In Britain, as in many countries, most notably in Europe, and more recently in the United States,[6] there is a widespread belief that government debt is a drain on economic resources.

However, this confuses foreign or ‘outside’ debt, such as arose under the gold standard, with the debt that backs credit in a credit-using economy. Contrary to a popular misapprehension, government debt is not a ‘burden on our children’ or a transfer of income from future generations to the present generation. A domestically held government bond is simply a commitment for future taxpayers to pay future bondholders in the same economy, with any decrease in national income only taking place if the bonds are issued to foreign residents.

In the case of the UK, less than 30% of government debt is held by foreign investors, and at least some of this will have been bought on the secondary market, repaying the original bondholders. Curiously, for a country whose government debts are the basis of foreign currency reserves in most countries of the world, the figure for US government debts is much the same.

The sale of government debt in the UK is organised by the Debt Management Office on behalf of the Treasury. Usually, the management of public debt is conducted with a view to minimising the cost of borrowing over the long term while minimising interest rate risk. This leads to a trade-off: shorter maturity gilts offer a lower borrowing cost but have to be regularly rolled over, exposing the government to the risk that interest rates might rise, while longer maturity gilts offer a higher borrowing cost but without any risk of this increasing in the short term. Longer term bonds also have the advantage that they can mop up excess liquidity in the financial markets. In fact, the Debt Management Office has the general objective of minimising borrowing costs using a broadly even split between bonds of different maturities, and a split between ordinary and index-linked bonds.

The benefit of financing deficits by issuing debt in the present conjuncture, aside from the advantages of absorbing excess liquidity and providing a stock of safe assets, is that interest rates on all maturities of debt are extraordinarily low. In fact, nominal yields on long-dated bonds were around 1% prior to the crisis,[7] and real yields have been negative across the entirety of the maturity spectrum for some time. In real terms, investors are paying the government to borrow, and in this situation the trade-off between funding cost and risk suggests that the Treasury ought to increase the emphasis on longer maturity gilts in their bond portfolio – particularly in a situation where a rapidly rising stock of debt inevitably raises the interest rate risk of short-dated bonds.

The best way, therefore, of financing the government’s emergency expenditure due to the Covid-19 crisis is through the issuance of long-term debt. As explained in an earlier report by Michell and Toporowski (2019), ‘Can the Bank of England do It?’, the experience of quantitative easing demonstrates that central banks have the capacity to control both short term interest rates and the yields of longer maturity debt, giving them de facto control of the yield curve after the last crisis[8]. Moreover, the flattening of the yield curve after 2008 introduced a number of potential risks, including a reduction in the profits of banks and the solvency of institutional investors, leading to the threat of disintermediation in the first case and a search for yield in riskier assets in the second. A larger stock of safe, long-dated bonds would allow the Bank of England to stabilise the yield curve at a level which ensured financial stability, providing a final benefit to the government of financing the crisis through the issuance of debt.

Estimates of the extent of extra government borrowing resulting from the crisis are in the region of £200 billion, and the government has announced that it intends to issue £180 billion of bonds between May and July 2020.[9] However, the Office of Budget Responsibility have been clear that the extra borrowing required to respond to the crisis could be considerably greater than this if the lockdown is longer than three months. The Resolution Foundation has made the same point, estimating that a six month lockdown would imply borrowing in the region of £400 billion.[10]

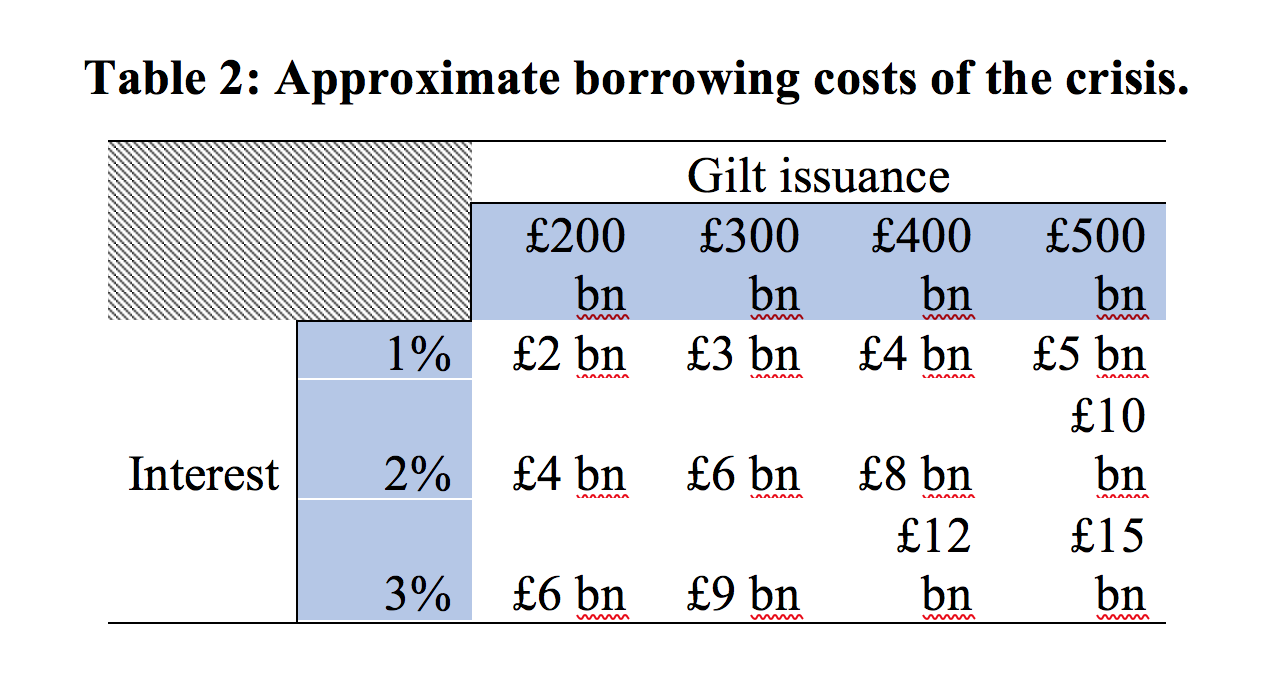

Table 2 presents a table of potential borrowing costs if the government finances its crisis expenditure by issuing long-term debt. If yields on long-dated gilts stay at around 1%, then the additional annual cost for servicing the increased debt can be expected to remain below £5 billion. Even if – as the Resolution Foundation warns against – interest rates rise to over 2%, we can reasonably expect the initial annual borrowing cost to remain somewhere between £5 billion and £15 billion per year.

Table 3: Revenue estimates from progressive taxation.

Tax | Revenue estimate |

Increase higher income tax rate by 1p | £1.35 bn |

Increase corporation tax by 1 percentage point | £2.8 bn |

IPPR net wealth tax (1% on non-pension assets exceeding £500,000) | £6.9 bn |

Persaud reforms to financial transaction tax | £4.68 bn |

If, therefore, the government were to finance its expenditure over the crisis by issuing 30 year ‘recovery bonds’ – 30 year gilts had a yield of 2% in January 2018, just under 1% in January of this year, and at the time of writing are trading with a yield market yield of less than 1% — it would face an initial annual borrowing cost which could easily be covered by increases in progressive taxation without the need to cut government spending. Moreover, if the government were to formalise the Bank of England’s efforts to stabilise the yield curve with an extension to its mandate, as suggested by Michell and Toporowski (2019), it could take advantage of the lower yields (and greater market depth) offered by shorter dated gilts without a considerable increase in interest rate risk.

Estimates of the marginal increase in annual revenue offered by different forms of taxation are presented in table 3, using information from HMRC’s 2019 ‘ready reckoner’ tables[11], the IPPR’s 2013 proposals for wealth taxation[12], and Avinash Persaud’s 2017 proposals for reforms to the taxation of financial transactions in the UK.[13] These are, of course, estimates based on economic data from previous years, but in two to three years’ time, after nominal GDP has recovered from the crisis, the orders of magnitude to be expected from similar tax increases should be similar to those presented in table 3. The IPPR notes that wealth taxes are relatively unusual today, but did exist in the past in countries like Austria, Germany and the Netherlands, and still exist in Norway and Switzerland. Persaud notes that, aside from the substantial revenues it would generate, reform of the UK’s financial transaction tax could improve financial stability, complement efforts to shift the economy away from short-termism, and improve HMRC’s knowledge of offshore assets held by UK residents.

Thus, introducing and reforming wealth taxation in the United Kingdom could raise the revenue necessary to cover the annual interest costs of long-dated gilts issued to finance government expenditure over the current crisis. Alternatively, the government could raise a non-trivial sum of money by increasing the higher rate of income tax by two or three pence, and a significant amount by increasing corporation tax from its current rate of 19%, which stood at 28% as recently as 2010. Certain figures in business might object to an increase in corporation tax, but there is little evidence that firms forego profitable opportunities just because 20%, 25%, or even 30% of those profits are taxed away. During the Second World War, whose financing is comparable to the present crisis, the government instituted an Excess Profit Tax to combat the egregious profiteering that had resulted from the more laisser-faire approach to financing the First World War. That Excess Profit Tax had raised the marginal rate of tax on profits to 75%.

Finally, as pointed out by Calvert Jump and Michell (2020)[14] and the Resolution Foundation, even in the long run, if interest rates were to rise to somewhere in the region of 2% and the entire outstanding stock of gilts were refinanced at market rates, financing the public debt would remain manageable. This is because existing gilts issued at less than 2% will take some time to refinance, and it seems reasonable to suppose that the Bank would extend quantitative easing if bond yields were to rise significantly in the absence of an economic recovery. In fact, the Bank announced an extra £200 billion of quantitative easing in March 2020, which will replace government bonds on private sector balance sheets with reserves that pay the Bank Rate.

Without knowing which gilts the Bank of England will buy – and therefore the yields on those gilts – it is difficult to estimate the flow effect on the public finances of this increase in quantitative easing. However, in 2017-18 the Bank paid less than £2 billion on the reserves issued to finance the existing amount of quantitative easing, earned £15 billion of interest on the gilts, and transferred a net sum of £9 billion to the Treasury[15]. Whatever savings are made on interest payments resulting from the recent extension to quantitative easing – and we might expect this to be in the low billions – will offset the initial interest costs given in table 2 and improve the sustainability of higher debt ratios in the long run.

3. Conclusion

The paper discusses the macroeconomic implications of various ways of financing the Covid-19 emergency. A ‘small government’ approach, minimising government expenditure, will lead to excessive reliance on private debt. This in turn will slow down the economic recovery and make it inflationary, as firms that run up emergency debt on their balance sheets seek to protect themselves against insolvency by increasing their prices, and reducing costs and business investment.

Monetising larger government expenditure will tend to destabilise the financial markets, threatening a fall in the exchange rate and inflation in this very open economy. The optimal solution is one based on the maintenance of high levels of government expenditure, financed by the issue of long-term bonds serviced by taxes on wealth and/or profits. The long-term bonds would stabilise the financial system by ‘sterilising’ the excess liquidity building up in the system due to forced saving and high levels of government expenditure. On the taxation side, taxes on wealth and profit taxes used to pay for government expenditure and debt servicing return the taxes to the savings of the wealthy through the claims of the wealthy on the profits of large corporations, and the income on the government bonds that the wealthy hold in their portfolios. Unlike more general taxation on wages and salaries, or expenditure taxes, like Value Added Tax, taxes on wealth on profits should not in principle discourage consumption or investment and may even encourage the latter with suitable tax deductions for investment.

Inevitably there will be concern about the level of government debt in relation to Gross Domestic Product. However, this is a problem of debt management which can be successfully overcome, as it was by the British Government when the ratio of its debt to GDP rose to some 2.5 times the current ratio. This was achieved in war-time. But similar levels of debt have been recorded by the Japanese Government in recent years, and the US Government manages with a debt to GDP ratio of 137%. Government debt is unjust and depresses economic activity if it is serviced by taxes on those with lower incomes. This should be avoided with taxes on wealth and profits that will benefit from a more rapid economic recovery.

[1] It was during the Second World War that the fiscal deficit in the UK reached its peak at 27% of GDP.

[2] https://obr.uk/coronavirus-reference-scenario/

[3] https://www.ifs.org.uk/publications/14771; https://www.instituteforgovernment.org.uk/explainers/coronavirus-public-borrowing

[4] https://www.bankofengland.co.uk/news/2020/april/hmt-and-boe-announce-temporary-extension-to-ways-and-means-facility

[5] See report on ‘Central banks’ appetite for dollars limited as conditions ease’ Financial Times 11 June 2020. https://www.ft.com/content/9f406da8-d1e6-4b16-ad2d-e69ec90d0749

[6] See John Cochrane https://johnhcochrane.blogspot.com/2020/06/perpetuities-debt-crises-and-inflation.html and R. Greenwood, S.G. Hanson, J.S. Rudolph and L.H. Summers ‘Government Debt Management at the Zero Lower Bound’ Working Paper No. 5, Hutchins Center on Fiscal and Monetary Policy at Brookings.

[7] https://www.dmo.gov.uk/media/16337/drmr2021.pdf

[8] https://progressiveeconomyforum.com/publications/can-the-bank-of-england-do-it-the-scope-and-operations-of-the-bank-of-englands-monetary-policy/

[9] https://www.gov.uk/government/news/hm-treasury-announces-revision-to-the-uk-debt-management-offices-financing-remit-2020-21

[10] https://www.resolutionfoundation.org/publications/doing-more-of-what-it-takes/

[11] https://www.gov.uk/government/statistics/direct-effects-of-illustrative-tax-changes

[12] https://www.ippr.org/publications/property-and-wealth-taxes-in-the-uk-the-context-for-reform

[13] https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2908464

[14]Calvert Jump R and Michell J (2020) Inside the black box: The public finances after coronavirus, IPPR.

http://www.ippr.org/research/publications/inside-the-black-box.

[15] See the OBR explainer at: https://obr.uk/forecasts-in-depth/brief-guides-and-explainers/direct-fiscal-consequences-unconventional-monetary-policies/