Last time, I laid out the idea of the U.S. as a bank to the rest of the world and looked at the liability side of its balance sheet. The idea has taken a bit more shape since I wrote it down, so I’ll take another stab, and also work the asset side into the picture.

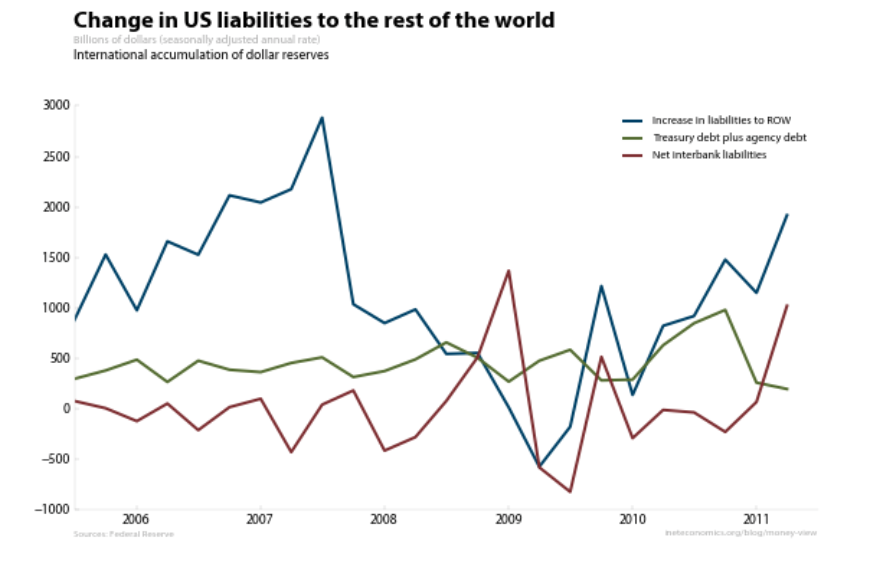

First, the liability side again:

Much of the financial crisis and its aftermath is written into this picture. Through mid-2007, the world was accumulating U.S. liabilities, but not Treasuries. The massive buildup, which ran up until the beginning of the crisis, was in corporate bonds, including asset-backed securities. As this market turned toxic at the end of that year, international purchases of these liabilities came to a halt (the blue line cliff-dives into 2008), bringing also to a halt the pre-crisis bank of the world.

I’m a bit uneasy putting too much on this data—quarterly observations at this level of aggregation is a too coarse to see what was really going on. All the same, I think that the right place to pick up the story is in the red line, interbank liabilities. As the crisis reached its height in late 2008, European banks rushed to support their US funding vehicles, frantically lending international dollars to them (the red line spikes up). This reversed in 2009, which represents, I think, US banks borrowing from the Fed’s emergency facilities and onlending to their parent companies abroad. This was the in-crisis version of the bank of the world, which provided liquid funds to its customers abroad.

The anemic post-crisis recovery gives us a third kind of bank of the world. As in the pre-crisis version, the world wants liquid U.S. liabilities, but now only safe liabilities will do. QE2 fits into this; it was about replacing Treasuries with money, meaning a decline in foreign accumulation of Treasuries and instead a rise in foreign deposits.

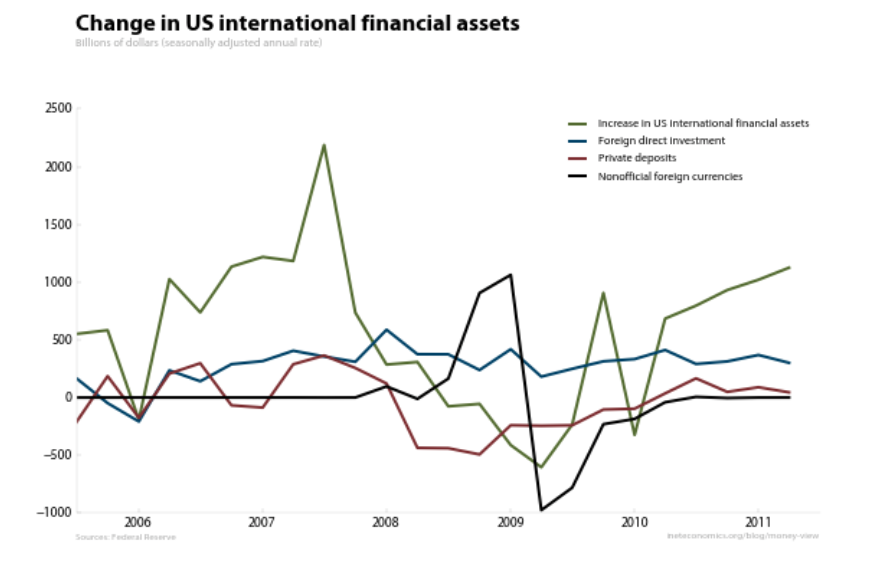

This characterization—pre-crisis issuer of ABS, in-crisis provider of dollars via the Fed’s liquidity backstops, post-crisis issuer of safe liabilities—helps interpret the asset side of our bank’s balance sheet as well:

Before the crisis, issuance of ABS funded a mix of international assets, including FDI and private deposits, as shown.

In the height of the crisis, as European banks scrambled for dollars, even breaking CIP. The U.S. was meeting the demand for dollars as best it could with the central bank liquidity swap lines. (These are the black line above, the series’s description in the data as “nonofficial” notwithstanding.) These were expanded at the end of 2008 and contracted in early 2009.

This gives a way of understanding the evolution of the U.S.’s international financial position, but not, I’m afraid, an easy way out of our current troubles. The debt-ceiling debacle, the austerity debate, and the U.S. as a relative safe haven amid the Eurozone crisis can all be understood through this lens.