Koo’s testimony is significant for INET because it helps inform our debate on the deficit. We’ve recently asked the

big question, “Will public deficit reduction encourage private sector growth, or undermine a needed stimulus to recovery?”

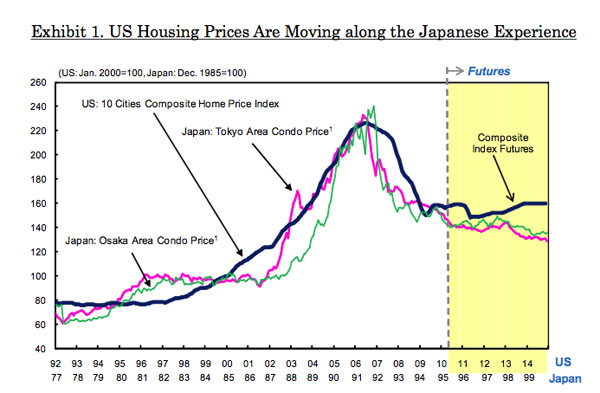

In his testimony, Koo pointed to Japan’s experiences during the 1990s, and said that there are “remarkable similarities” between that country’s house price movements during that time and U.S. housing markets right now. He provided a chart that demonstrated this correlation:

Japan suffered from what Koo calls a “balance sheet recession,” that did not evolve into a full-blown depression because of the government’s willingness to maintain stimulus efforts until the private sector was healthy enough to be self-sustaining.

Judging from the Japanese experiences, Koo said that the G-20’s proposition to halve deficits by 2013 is ill-advised, and that “consolidation must wait until it is certain the private sector has vanished deleveraging and is healthy enough to borrow and spend the savings left unborrowed as a result of the government’s austerity measures.”

To read more about INET’s Deficit Debate, please see our page here.

Here is a talk that Koo gave at our inaugural conference at King’s College, in which he more fully discussed “balance sheet recessions” and Japan’s experiences in the 1990s: