Proprietary trading by Wall Street banks precipitated the 2008 financial crisis that resulted in a near 13 trillion dollar bailout by American taxpayers of Too Big To Fail financial institutions. As early as 2007, Morgan Stanley lost $9 billion dollars due to bullish bets on complex derivatives related to mortgages and in 2008 American International Group famously lost billions of dollars betting on complex derivatives. Similarly, toward the end of 2008, Merrill Lynch lost nearly $16 billion and Deutsche Bank lost nearly $2 billion due to complex bets on risky securities. Additionally, JPMorgan’s $9 billion loss on a giant derivatives trade made by its London trading desk known colloquially as the London Whale is a stark reminder that proprietary trading by Too Big To Fail financial institutions poses an acute risk to U.S. financial markets and exposes U.S. taxpayers to the risk of future bank bailouts.

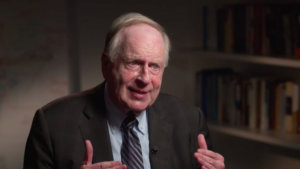

The whole rationale for what ultimately became known as the “Dodd-Frank” bill was to prevent a recurrence of the 2008 crisis. Has it served its purpose? No, according to Michael Greenberger, a Professor at the University of Maryland Francis King Carey School of Law, and a former top official with the Division of Trading and Markets at the Commodity Futures Trading Commission (CFTC) working directly for then-Chairperson Brooksley Born. He focused on issues relating to financial regulation and derivatives.

He argues that investors have little confidence in banks because they’ve grown since the financial crisis and have managed to delay or water down much of the most robust regulatory proposals initially outlined in the wake of the crisis.

“The reason their current and prospective investors are concerned is that there’s every likelihood that what happened in 2008 will repeat itself,” he said, calling the rigging of global interest rates and recurrent trading losses since the 2009 as evidence of ongoing systemic instability.