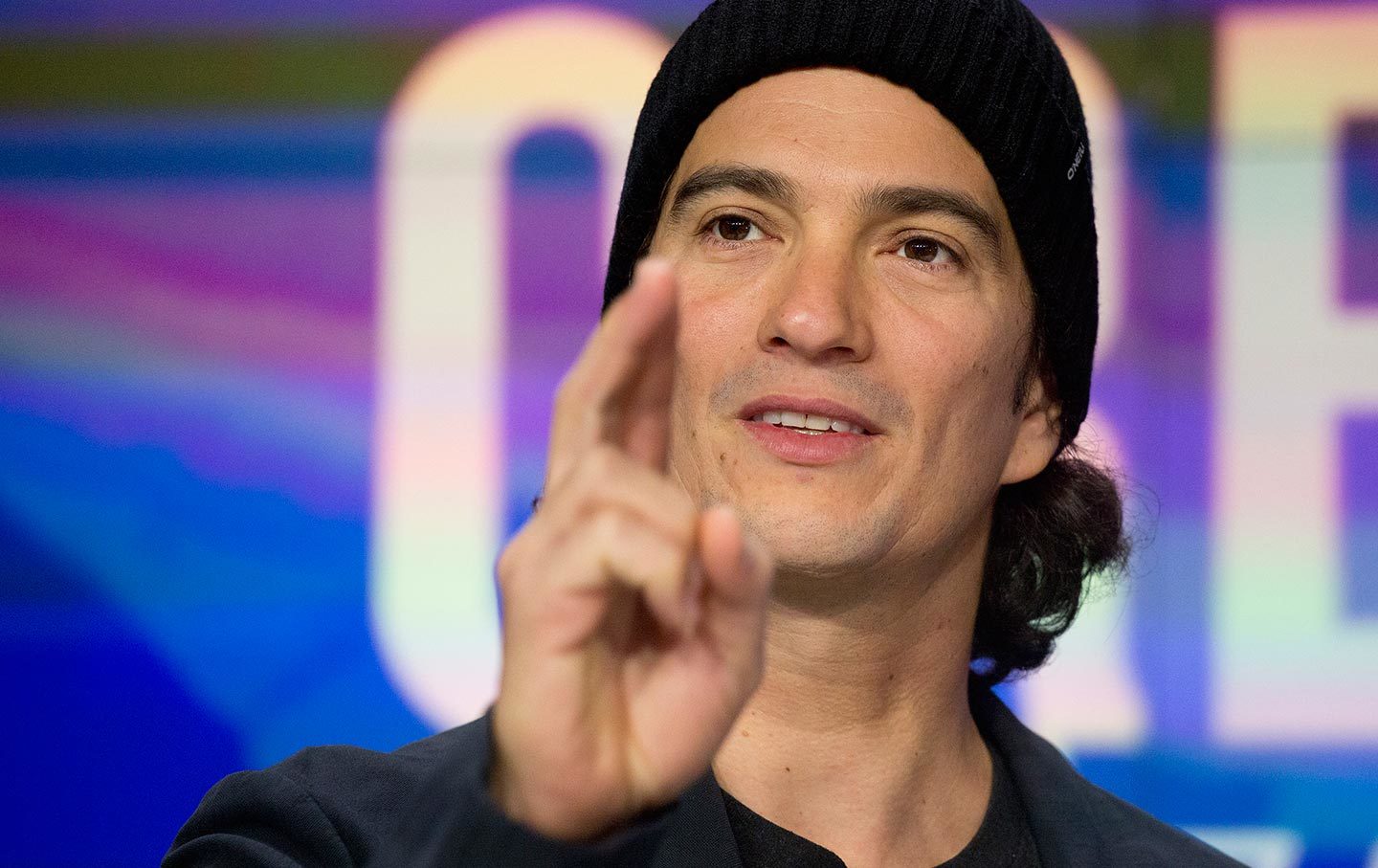

Even the most casual follower of the business press has heard of the butt of the start-up world’s latest joke: Adam Neumann.

Neumann is the billionaire cofounder of the We company (formerly WeWork), the coworking-space start-up valued at $47 billion in January of this year. WeWork was the latest and greatest “unicorn,” a massive disrupter to the commercial real estate industry, for whom the sky was literally the limit. And Neumann was the archetypal Silicon Valley founder, a genius wunderkind with a taste for lavish spending—more than $80 million on five homes since founding WeWork in 2010—and “eccentric” habits, such as bringing so much marijuana onto an international flight that the private jet’s owner feared drug trafficking charges.

Then, suddenly, the man and the myth came crashing down. In August, WeWork filed paperwork for its initial public offering, which showed spiraling losses over the last three years, including a net loss of $1.6 billion in 2018 on revenue of $1.8 billion. Investors started to panic, the company delayed its IPO, and then The Wall Street Journal published a bombshell profile of Neumann, revealing a founder who had used his cash-hemorrhaging company’s funds to buy himself a $60 million private jet and host a booze-filled private music festival just outside London.

For those of us who have long been skeptical of the fetishization of start-ups—whose “disruption” of sectors from taxis to toothbrushes often rests on a combination of worker exploitation and cult of personality—Neumann’s fall from grace is just the latest instance of start-up schadenfreude. From Theranos’s Elizabeth Holmes to Uber’s Travis Kalanick, some of the last decade’s most prominent business stars have been laid bare as glorified con artists, while a growing chorus of podcast-listening and TV-watching fans have feasted on tales of their self-immolation.

The twilight of the Silicon Valley founder feels pretty great. But the obvious alternative may be no better.

That’s because it’s not just ordinary people who have grown skeptical of Neumann and his ilk: Big investors and financiers are also out for blood. Venture capitalists have long been the great enablers of the founders, shoving their glut of capital into any pitch deck that says “disrupt” enough times. The logic—if you can call it that—was that exceptional returns in the face of mediocre fundamentals could only be the product of exceptional founders. Or, to put it another way: Even though the emperor has no clothes, you can still turn a profit from them, so long as everyone believes in the myth.

But as the start-up bubble risks bursting, investors are seeing founders less as human ATMs, and more as liabilities.

The result may well be a return to the old model of start-ups: rule of the shareholder. As NYU marketing professor and entrepreneur Scott Galloway put it in an interview with New York magazine, “There’s always a tension between capital and founders around who has power. Ever since Steve Jobs and Bill Gates, slowly but surely the pendulum has swung back to the founder. In the ’90s, founders didn’t survive. We were seen as crazy, and once the company became real, we were to be shoved to the side and some 55-year-old CEO from PepsiCo was supposed to come in and be the real CEO.”

The period that Galloway describes here—the 1980s and ’90s—was the heyday of corporate raiders and activist shareholders. Sharks like Carl Icahn and T. Boone Pickens swam through the sea of American business, buying up companies in order to sell off operations, lay off workers, and squeeze out any and all value to greedy investors before tossing them aside. This was the birth of the doctrine of “shareholder value”—that a company’s sole objective is to divert as much cash and profit as possible to shareholders (the vast majority of whom never even invested in the company itself, instead buying shares in the casino of the open market), at the expense of workers, the environment, public welfare, and even innovation.

Today, that doctrine has become accepted wisdom on Wall Street, where stock buybacks—in which a company spends its profits on buying back its public shares, effectively inflating the price of investor-held stock—have reached record levels (though the Business Roundtable, a grouping of the CEOs of America’s largest companies, has claimed to be rethinking the “investors first” approach). And with stock ownership increasingly concentrated in the hands of a wealthy and unaccountable few, “shareholder value” is shorthand for the class warfare of rich against poor.

It may seem far-fetched to imagine the individual, personality-driven, erratic world of start-ups giving way to the pharmaceutical industry’s crude arithmetic of shareholder value, but it’s happened before. As Galloway mentions, no less famous a founder than Steve Jobs himself was once pushed out by shareholders in search of better returns.

His replacement—John Sculley, formerly of PepsiCo—did just as much damage, only without Jobs’s cult of personality. He pursued shareholder value aggressively and at the expense of the 1,200 workers he fired and three factories he closed after taking over Apple in 1985. And while Jobs and the myth of the founder emerged victorious and massively profitable in the late 1990s, since Jobs’s death and replacement by current CEO Tim Cook, Apple has again become a crusader for shareholder value: In 2018 the company spent a record $73 billion—123 percent of its net income—on buying back its stock.

The pendulum of Silicon Valley swings between recklessly spending massive amounts of money on shareholders, and recklessly spending massive amounts of money on founders. In both cases, the losers are the workers, who get laid off by corporate raiders or manic founders; the public, which has potentially life-changing innovations squandered on big egos and deep pockets; and the planet, which is disregarded by those seeking short-term profits or fame. As odious as the founders might be, the dictatorship of the investors class is hardly an improvement.

Fortunately, there are proposals to reform the Valley that offer a way out of this bind, by forcing founders and shareholders to invest in the group they both ignore: working people.

Senator Tammy Baldwin, for instance, has proposed legislation to ban stock buybacks on the open market, compelling companies to instead spend their profits on workers, sustainable innovation, and growth that benefits the public. Senator Bernie Sanders has proposed a wealth tax that would cut the wealth of billionaires in half over 15 years, redirecting the glut of unproductive venture capital into much-needed government programs.

In California, a new law requiring gig workers to be classified as benefit-entitled employees has Uber on the backfoot. And proposals from Sanders and Senator Elizabeth Warren to vastly expand the power of workers to unionize and have a say in company management would ensure that start-up profits are shared with the workers who actually make their products possible.

Looking farther ahead, progressive think tanks like the Next System Project and the People’s Policy Project have put forward programs for the collective ownership of large companies, ensuring that growing start-ups serve the common interest, rather than the narrow and short-term concerns of founders and wealthy investors.

Ultimately, the start-up industry’s pendulum, swinging between the predations of founders and shareholders, is endemic to capitalism itself, where profits accrue to capital owners and losses are socialized. While the demise of the Silicon Valley founder, the railroad baron of our Gilded Age, is welcome and overdue, it alone does not offer a solution to the greed and nearsightedness that plague the start-up world. Only by democratizing the work of innovation can we ensure that it works for the many, not the few.

This article originally appeared on TheNation.com